|

Alabama Unsecured Promissory Note Template |

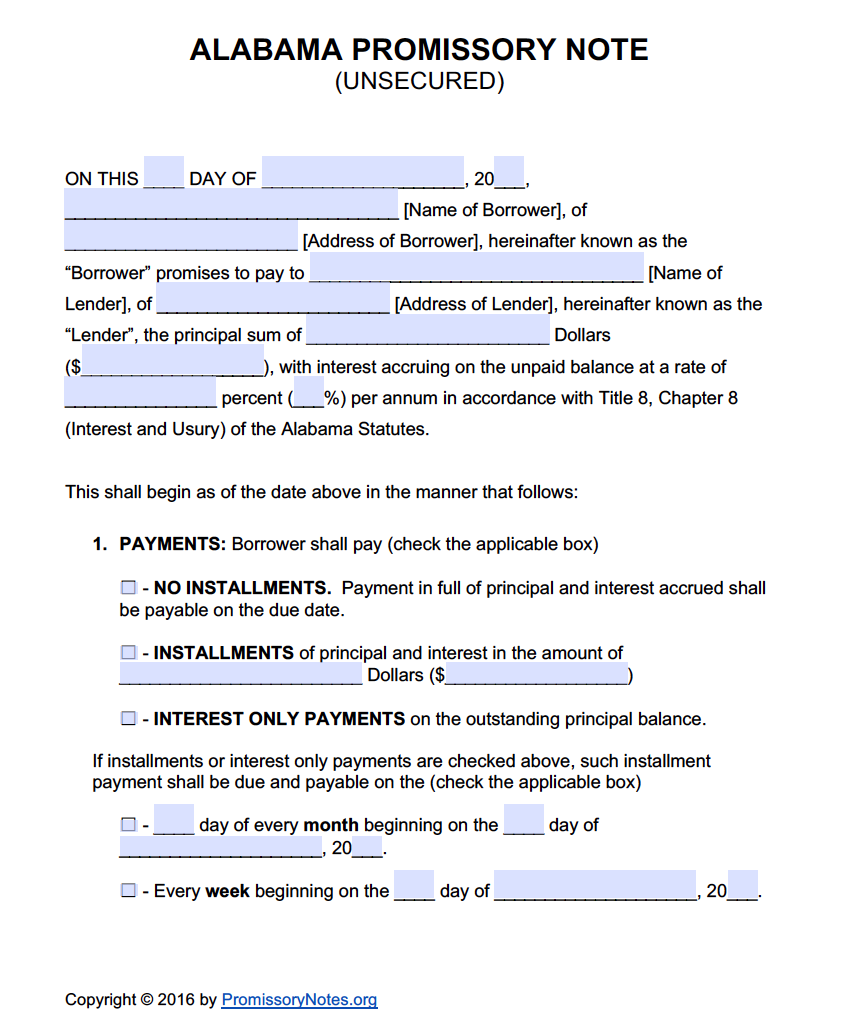

The Alabama unsecured promissory note template is a legal, interest bearing document, that is implemented between a lender and borrower. The lender would provide a monetary loan to the borrower without the necessity of any property in place to provide security, in the event of default. Generally, in this case, the borrower is considered low risk and therfore the lender is confident that the borrower will repay the note without incident.

The document would remain enforceable, however, on the strength of the document’s witnessed signatures. Once completed, the form must be witnessed and signed by two witnesses so that it may be effective.

How to Write

Step 1 – Begin by Downloading the Note Document – Enter the following information:

- The beginning date of the document in dd/m/yy format

- The borrower’s name

- The borrower’s address

- AND

- The Lender’s name

- The lender’s address

- AND

- Submit the principal sum of the agreement

- The percentage of the accruing interest (annual)

Step 2 – Payments –

- Select and check the box that would best indicate the agreed method of payment and complete as follows:

- No Installments

- Installments – Submit the payment amount to include interest

- Interest Only Payments

If either “installments” or “interest only payments” are selected, check the box that woould best indicate the payment frequency and complete the following information:

- Monthly – Submit the day of each month that payments must be received as well, the beginning date in dd/m/yy format

- Weekly – The commencement date in dd/m/yy format

Due Date –

- The date that the note must be paid in full including accrued interest and late fees (if any) – Enter a due date in dd/m/yy format

Interest Due in the Event of Default –

- Read the information and enter the agreed interest rate

- Submit the percentage per annum

Step 3 – Titled Sections – Read and review (if needed); all titled sections. Provide any required information, within each section, if needed, as follows:

- Allocation of Payments

- Prepayment

- Late Fees (submit the number of days in which the borrower must pay to avoid late fees) – Also, submit the agreed late payment fee that to be due, with each late payment

- Acceleration – Provide the agreed number of days, in which the borrower shall have available to them, to cure any default due to late payments

- Attorney’s Fees and Costs

- Waiver of Presentments

- Non-Waiver

- Severability

- Integration

- Notice

- Excecution

Step 4 – Signatures – Witnesses must be present to witness the parties signature, before signing:

- Date all parties signatures in dd/m/yy format

- Submit the lender’s signature

- Print the lender’s name

- AND

- Submit the borrower’s Signature

- Print the borrower’s name

- AND

- Witnesses signatures (signed respectively)

- Witnesses printed names

Alabama Unsecured Promissory Note – Adobe PDF – Microsoft Word