|

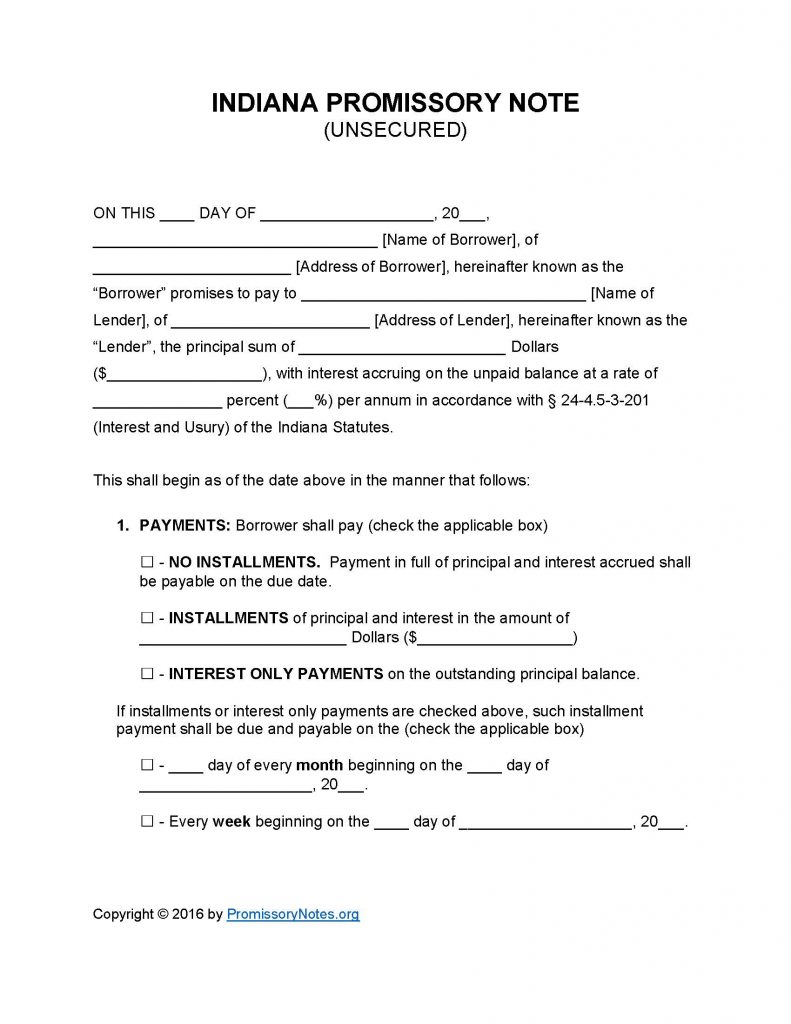

Indiana Unsecured Promissory Note Template |

The Indiana Unsecured Promissory Note Template can be download in MS Word or .PDF format. Unsecured promissory notes differ from secured ones because they are not backed by collateral. For this reason, unsecured notes/loans are usually only given to borrowers who are not at risk of defaulting. If a borrower ends up on defaulting on an unsecured loan, the lender will typically end up taking a loss on it. This is why unsecured loans are typically only used for “low risk” borrowers.

Use the links at the top of this page to download the template.

How to Write

Step 1 – Download the file in your format of choice.

Step 2 – Provide the following:

- Enter the name of the borrower and their address.

- Submit the name/address of the lender.

- AND

- Principal amount

- Interest rate (per annum)

Step 3 – Payments – Submit the following information:

- Payment method (check the corresponding box).

- Enter the installment amount (if applicable).

- Provide the monthly/weekly due date information (if applicable).

Step 4 – Due Date:

- Enter the due date of the principal sum in the provided format.

Step 5 – Interest Due in Event of Default:

- Provide the interest rate that will be applied to the balance should the borrower default on the loan.

Step 6 – Late Fees:

- Provide the number of days the borrower will have to make a past-due payment.

- Enter the late fee amount (if the borrower misses the past-due payment date this amount will be applied to the balance).

Step 7 – Acceleration:

- Submit the period of time the borrower will have to cure a default.

Step 8 – Signatures:

- Borrower’s name and signatures

- Lender’s name/signature

- Names/signatures of witnesses

Indiana Unsecured Promissory Note – Adobe PDF – Microsoft Word