|

South Carolina Unsecured Promissory Note Template |

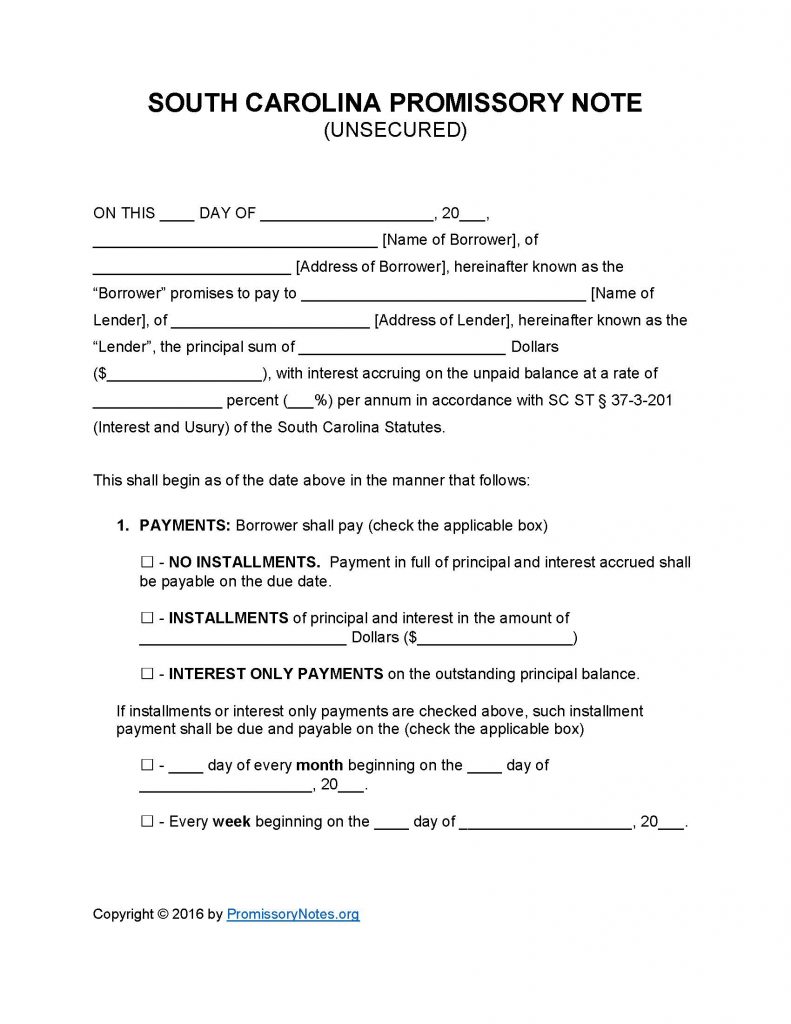

The South Carolina Unsecured Promissory Note Template can be downloaded in two separate formats: .PDF or MS Word. The template is designed to be used as a starting point when drafting an unsecured note. An unsecured promissory note details the parties, principal sum, interest rate, payment method/schedule, etc. of a loan.

Note: Unsecured notes do not have the backing of collateral (pledged from the borrower).

How to Write

Step 1 – Use the links near the top of the page to download the template in your preferred format.

Step 2 – Provide the following details:

- Date of note

- Names of borrower/lender

- Addresses of borrower/lender

- AND

- Submit the amount that will be loaned to the borrower.

- Enter the interest rate.

Step 3 – Payments – Choose the borrower’s payment method from the available options:

- No Installments

- Installments (payment amount must be entered)

- Interest Only

Step 4 – If applicable:

- Provide the monthly/weekly payment schedule.

Step 5 – Due Date:

- This subsection must contain the principal sum’s final due date.

Step 6 – Interest Due in Event of Default:

- Provide the interest rating that the borrower will be charged if they default on the loan.

Step 7 – Late Fees:

- Submit the period of time the borrower will have to make a past-due payment before a late fee will be charged to the balance.

- Enter the late fee amount.

Step 8 – Acceleration:

- Fill in the number of days that the borrower will have to cure a default. If the borrower fails to cure the default within this time period, the lender can declare the full sum of the loan (and any other fees) due immediately.

Step 9 – Signatures – Fill out this subsection by providing the following:

- Date

- Names of borrower/lender

- Signatures of borrower/lender

- Names/signatures of witnesses

South Carolina Secured Promissory Note – Adobe PDF – Microsoft Word