|

Unsecured Promissory Note Template |

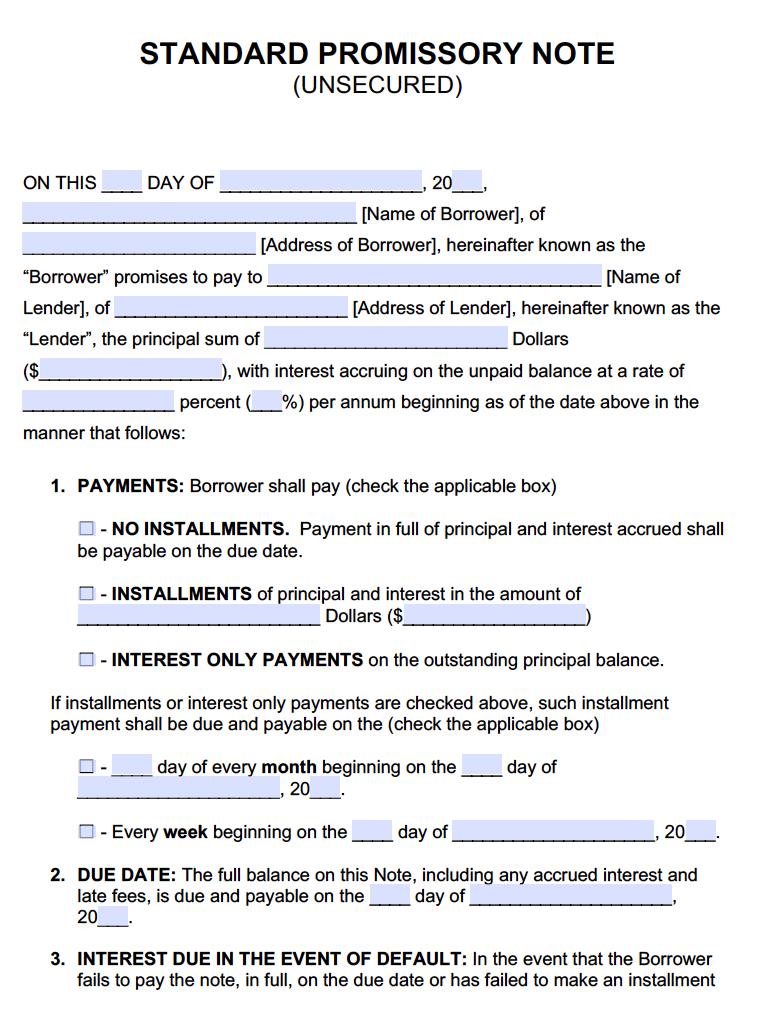

The unsecured promissory note template is a document that allows a lender to detail an amount of money that is given to someone else (the ‘borrower) with the intention of being reimbursed with interest (if any). Although, with an unsecured note, the lender is not guaranteed any asset(s) if in the chance the borrower does not pay-back the loan. In this case the unsecured note is nothing more than an “I Owe You” as it does not guarantee anything to the lender other a promise to pay.

Forms By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How to Write

Step 1 – Download the Document – Provide the following:

- The date of the execution of the document in dd/m/yy format

- Enter the borrower’s name

- Borrower’s address

- AND

- Enter the name of the lender

- Lender’s address

- AND

- Submit the principal sum of the note

- Enter the percentage of the accruing interest annually

Step 2 – Payments –

- Select and check the box that would best indicate the agreed method of payment and complete as follows:

- No Installments

- Installments (enter the payment amount that shall include principal and interest)

- Interest Only Payments

Should the selection be either “installments” or “interest only payments” check the applicable box and complete the following information pertaining to how payments shall be made as follows:

- Monthly – Enter the day of each moth that payments must be received and the beginning date to commence on dd/m/yy format

- Weekly – with the beginning date to commence in dd/m/yy format

Due Date –

- Shall be paid in full to include accrued interest, late fees (if any) – enter the due date in dd/m/yy format

Interest Due in the Event of Default –

- Read the information entirely and enter an interest rate

- Enter the percentage per annum

Step 3 – Titled Sections – Read all of the titled sections carefully. Enter any additional required information, if needed, within in each section as follows:

- Allocation of Payments

- Prepayment

- Late Fees (submit the number of days in which the borrower must pay to avoid late fees) – As well, enter the late payment fee that would be due with each late payment

- Acceleration – Enter the number of days in which the borrower shall have to cure default due to late payments

- Attorney’s Fees and Costs

- Waiver of Presentments

- Non-Waiver

- Severability

- Integration

- Notice

- Excecution

Step 4 – Signatures – The document shall require the signatures of two witnesses

- Date the signatures in dd/m/yy format

- Enter the lender’s signature

- Print lender’s name

- AND

- Borrower’s Signature

- Print the borrowe’s name

- AND

- Witnesses respective signatures

- Witnesses printed names

Unsecured Promissory Note – Adobe PDF – Microsoft Word