|

Michigan Secured Promissory Note Template |

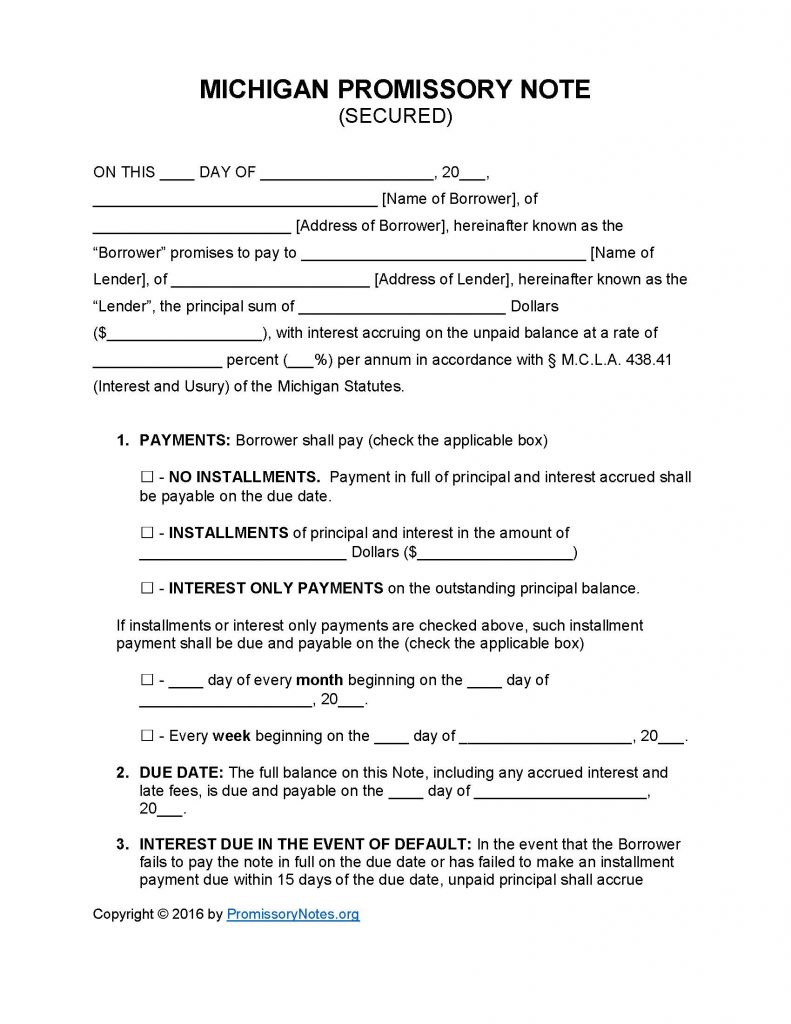

Use the links posted on this page to download the Michigan Secured Promissory Note Template. The template is designed to be filled out quickly and easily (the instructions posted below detail how to complete the form). Secured notes require that the borrower provides assets as collateral. The lender can take possession of this collateral if the borrower defaults on the note/loan.

Note: In order for the document to be legally enforceable all of the involved parties must review/sign it.

How to Write

Step 1 – Download the document.

Step 2 – On the first page of the form (in the first paragraph), submit the following details:

- Full name and address of borrower

- Name and address of lender

- Principal sum AND interest rate

Step 3 – Payments: In this subsection the payment method, frequency, and installment amount (if applicable) must be submitted:

- Select the payment method from the available options.

- Provide the installment amount if required.

- Enter the due date if applicable.

Step 4 – Due Date:

- Fill in the due date information.

Step 5 –

Interest Due in Event of Default:

- Submit the interest rate that will be charged to the balance if the borrower defaults on the loan.

Step 6 – Late Fees:

- The borrower will have a certain number of days to submit a late payment before the lender can apply a late fee charge to the balance.

- Enter the charge that will be applied, as well as the number of days the borrower will have past the initial due date to make a payment.

Step 7 – Acceleration:

- Enter how much time the borrower will have after defaulting to cure the default (before the lender demands the entire balance of the loan due immediately).

Step 8 – Security:

- Enter a description of the pledged assets.

Step 9 – Signatures:

- Provide the date of signing in the first input field.

- Enter the names of all the parties involved.

- Each party must sign their name.

Michigan Secured Promissory Note – Adobe PDF – Microsoft Word