|

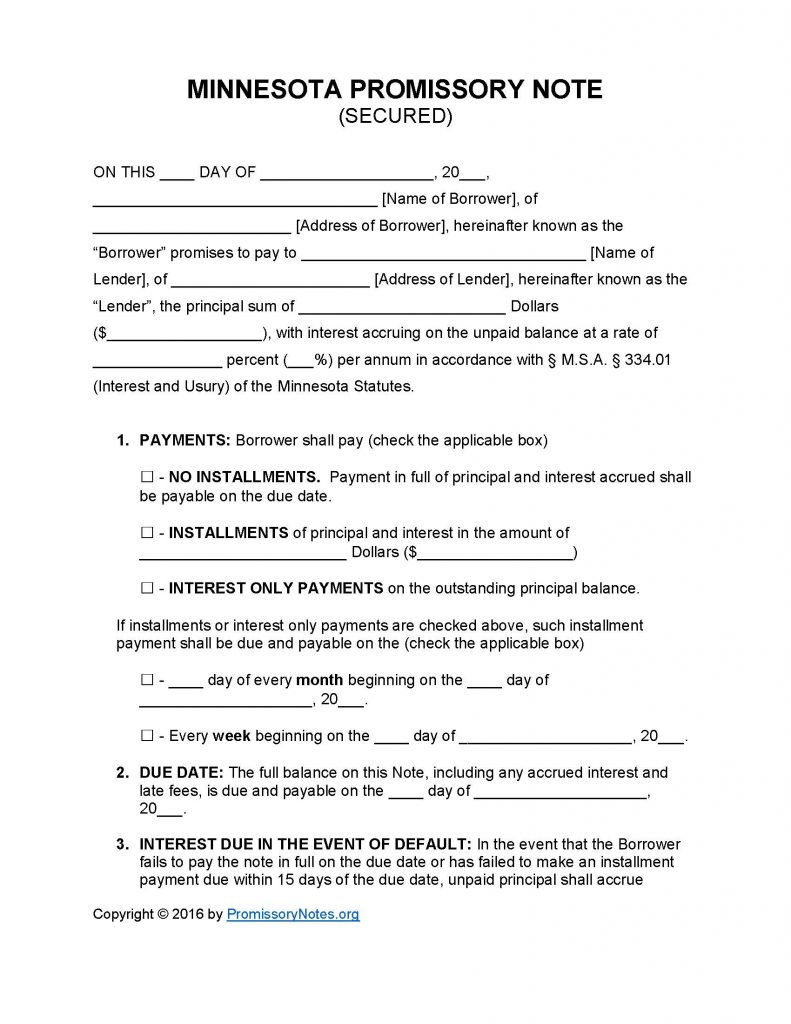

Minnesota Secured Promissory Note Template |

The Minnesota Secured Promissory Note Template is a legal document used to detail the principal sum, interest rate, payment method, and other facets of a loan. The borrower is required to pledge collateral when signing the secured promissory note. The reason for this is that in the event of a default on the note/loan, the lender can take possession of the pledged assets (in order to satisfy the debt that is owed).

How to Write

Step 1 – Download the document via the links near the top of the page.

Step 2 – Opening Paragraph:

- Submit the name of the borrower

- Address of borrower

- Name of lender

- Address of lender

- AND

- Provide the principal sum/interest rate

Step 3 – Payments – Check the box of the agreed upon payment method:

- No Installments

- Installments (submit the agreed upon amount)

- Interest Only

Step 4 – Provide the monthly/weekly installment frequency (if required).

Step 5 – Due Date:

- Enter the date in dd/m/yy format.

Step 6 – Interest in Event of Default: If the borrower defaults on the loan/note, the lender can apply an updated interest rate to the balance.

- Submit the updated interest rate.

Step 7 – Late Fees:

- Provide how long the borrower will have after missing a payment before the lender will charge a late fee.

- Submit the agreed upon late fee.

Step 8 – Acceleration:

- Fill in the number of days the borrower will have to cure a default.

Step 10 – Security:

- Enter the borrower’s pledged assets.

Step 11 – Signatures:

- Provide the date in the required format.

- Enter the names of the lender/borrower.

- The borrower AND lender are required to sign the form.

- The witnesses must print/sign their names in the appropriate input fields.

Minnesota Secured Promissory Note – Adobe PDF – Microsoft Word