|

Virginia Unsecured Promissory Note Template |

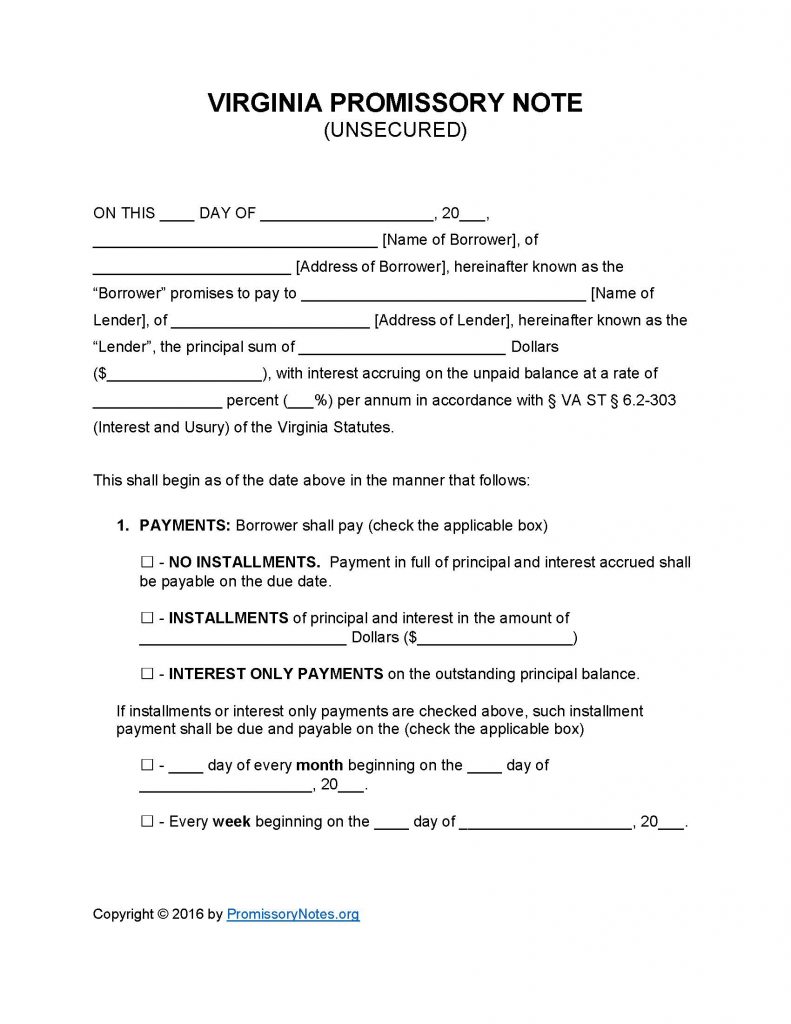

The Virginia Unsecured Promissory Note Template is a legally enforceable document that provides a detailed outline of a loan’s various terms. The unsecured note template should only be used to draft an agreement where the borrower is not providing some form of collateral (as security). The instructions posted below can be used as a guide when drafting your promissory note (to ensure that the template is properly filled out).

How to Write

Step 1 – Download the document in .PDF or Word format.

Step 2 – Fill in the following details:

- Date of note

- Name of borrower

- Address of borrower

- Name of lender/address of lender

- Principal sum of note

- Interest rate that borrower will be charged

Step 3 – Payments:

- Select the appropriate payment method (“No Installments” – “Installments” – “Interest Only”).

- If the chosen method of repayment is either “Installments” or “Interest Only,” the due date information (entered in monthly or weekly format) must be provided.

Step 4 – Due Date:

- This subsection details the date in which the loan’s full balance (including fees) must be paid off by.

Step 5 – Interest Due in Event of Default: If the borrower defaults on the loan they will be required to pay the interest rating submitted in this subsection.

Step 6 – Late Fees:

- Should the borrower fail to make a scheduled payment, they will be required to pay the late fee described in this subsection.

Step 7 – Acceleration:

- After the borrower has defaulted on the loan, they will have the number of days entered in this subsection to cure the default.

Step 8 – Signatures:

- Provide the date, and the names of each party.

- The borrower, lender, and witnesses MUST sign the note for it to be legally valid.

Virginia Unsecured Promissory Note – Adobe PDF – Microsoft Word