|

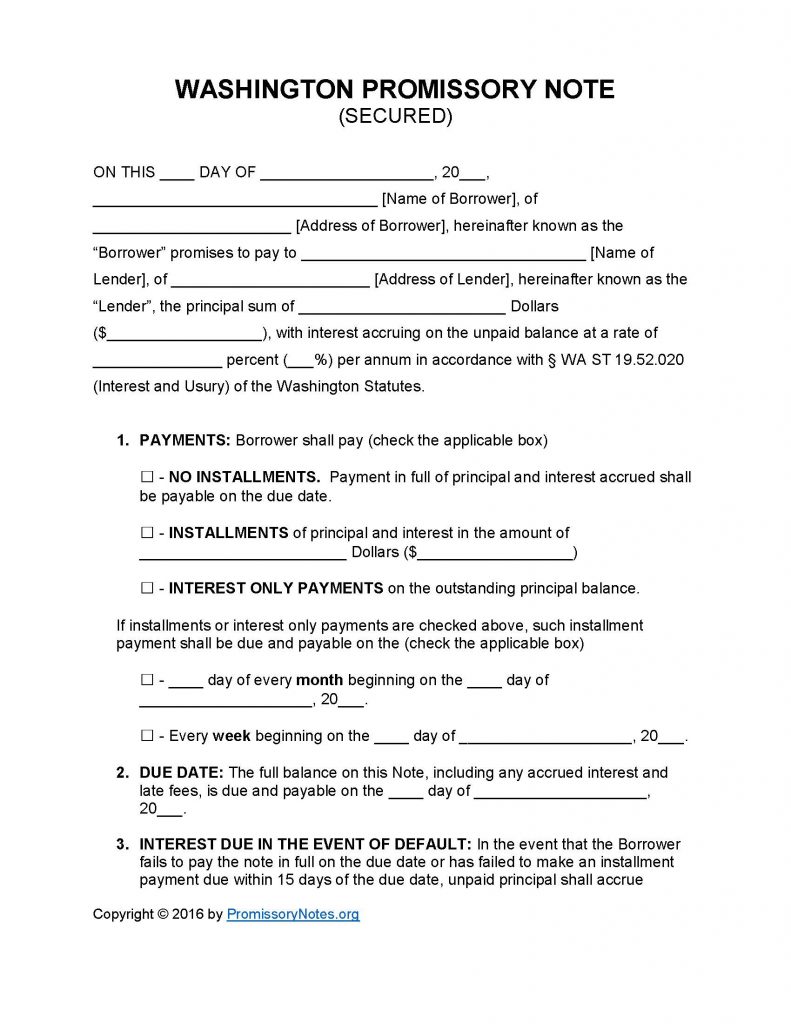

Washington Secured Promissory Note Template |

The Washington Secured Promissory Note Template is a pre-written form that only needs to be filled in with the terms of a loan in order to be completed. Use the how-to guide posted below when drafting the secured note to make sure that it contains all of the required details.

- Note: Secured promissory notes require that the borrower pledge collateral (i.e. security) in exchange for receiving a loan. The note must contain a description of the secured asset(s), and some states require an additional security agreement.

How to Write

Step 1 – Download the template.

Step 2 – Fill in the first paragraph with the following:

- Date

- Borrower’s name/address

- Lender’s name/address

- Amount of loan

- Interest rate

Step 3 – Payments – The borrower’s form of payment must be chosen by checking the appropriate box:

- No Installments

- Installments – If this is the selected payment method, the installment amount must be entered.

- Interest Only

Step 4 – If the selected payment method is “Installments” / “Interest Only,” the payment frequency must be submitted.

Step 5 – Due Date:

- Fill in the date in the provided format.

Step 6 – Interest Due in Event of Default:

- Review the subsection and then enter the interest rate.

Step 7 – Late Fees:

- Submit the period of days in which the borrower will have after missing a payment before they will be charged a late fee.

- Submit the amount of the late fee.

Step 8 – Acceleration:

- Provide how long the borrower will have to cure a default.

Step 9 – Security:

- Submit the pledged collateral of the borrower.

Step 10 – Signatures:

- Fill in the date in the required format.

- Print the names of the borrower, lender, and witnesses.

- Borrower, lender, and witnesses must sign the note in the appropriate input fields.

Washington Secured Promissory Note – Adobe PDF – Microsoft Word