|

Michigan Unsecured Promissory Note Template |

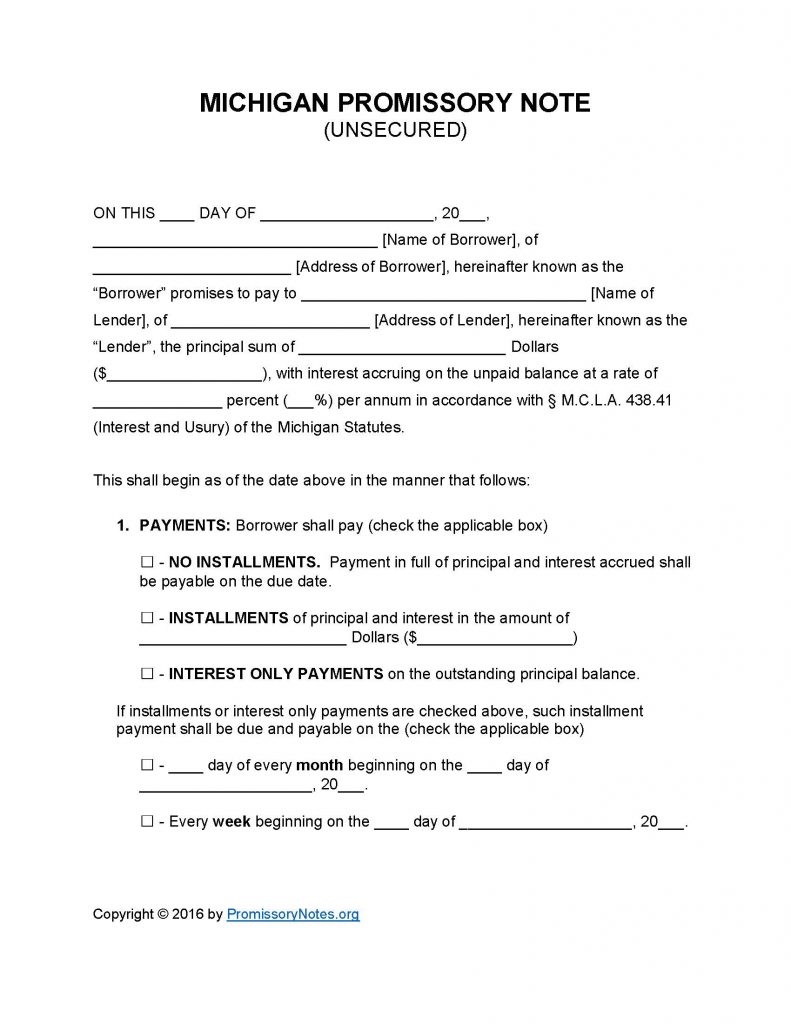

The Michigan Unsecured Promissory Note Template is a written agreement regarding a loan that is entered into by two parties – a lender and borrower. The agreement outlines the principal sum, interest rate, payment frequency, and other terms of a loan. The reason that it is “unsecured” is because the borrower does not pledge collateral (as opposed to a secured note). Should the borrower default on the loan, the lender’s only recourse is to file a civil suit. This is why unsecured notes/loans are typically reserved for borrowers who have a high net worth (or an excellent credit history).

How to Write

Step 1 – Download the template in the format of your choice.

Step 2 – Provide the following information:

- Name of borrower

- Address of borrower

- Name of lender

- Address of lender

- Principal sum

- Interest rate per annum

Step 3 – Payments – Select the appropriate payment method by checking the box off (from the following options):

- No Installments

- Installments

- Interest Only

Step 4 – If applicable:

- Provide the installment amount

- Enter the monthly/weekly due date

Step 5 – Due Date:

- Submit the due date in the provided format.

Step 6 – Interest Due in Event of Default:

- Provide the interest rate that the borrower will need to pay if they default on the loan/note.

Step 7 – Late Fees:

- Fill in the late fee amount.

- Enter the number of days the borrower will have after missing the due date to make the payment (before the late fee is charged to his/her account).

Step 8 – Acceleration:

- Fill in the amount of time the borrower shall have to cure a default.

Step 9 – Signatures:

- Provide the date of signing.

- Enter the full names (printed) of all the parties involved in the agreement.

- Borrower must sign their name.

- Lender/witnesses must sign the form.

Michigan Unsecured Promissory Note – Adobe PDF – Microsoft Word