|

Arkansas Unsecured Promissory Note Template |

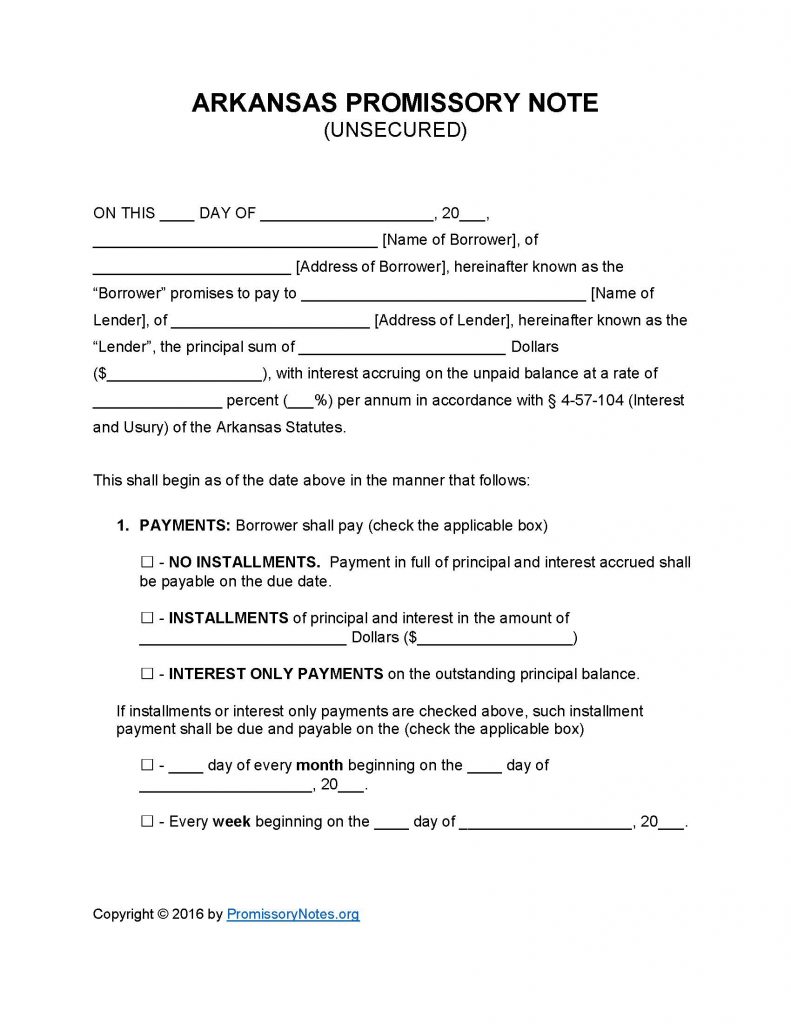

The Arkansas Unsecured Promissory Note Template is a written agreement that outlines the terms of a loan. The payment method, term length, interest rate, and other related details comprise the bulk of the document. The note is “unsecured” because it is not backed by the collateral of the borrower. Use the links on this page to download the document in .PDF or Word format. The .PDF file can be filled out and signed electronically.

How to Write

Step 1 – Download the template.

Step 2 – Submit the following details:

- Name of borrower

- Address of borrower

- Name of lender

- Address of lender

- Principal sum

- Interest percentage (maximum allowed in Arkansas is 17% as outlined in Article 19, §-13).

Step 3 – Payments:

- Select the payment method from the list of three options (“No Installments,” “Installments,” or “Interest Only”).

- If “Installments” or “Interest Only” are chosen you must enter the payment frequency information by filling out the blank input fields.

Step 4 – Due Date: The date that the entire sum of the loan (in addition to interest/late fees) is due by. Fill in the date and then move on to the next section.

Step 5 – Interest Due in Event of Default: Submit the interest rate that will go into effect if the borrower defaults on the loan. The interest rate will remain in effect until the borrower is no longer in default.

Step 6 – Late Fees:

- Fill in the number of days that the borrower will have until late fees will be added onto the required payment.

- Enter the late fee amount.

Step 7 – Acceleration:

- Enter the number of days the borrower will have to “cure” a default.

- If the borrower fails to cure their default within this time period, the lender may declare the entire balance due immediately.

Step 8 – Signatures:

- Date the form.

- Both parties (lender/borrower) are required to print/sign their names in the appropriate input fields on the last page of the note.

- Two witnesses must print/sign their names within the allocated sections on the last page of the document.

Arkansas Unsecured Promissory Note – Adobe PDF – Microsoft Word