|

California Unsecured Promissory Note Template |

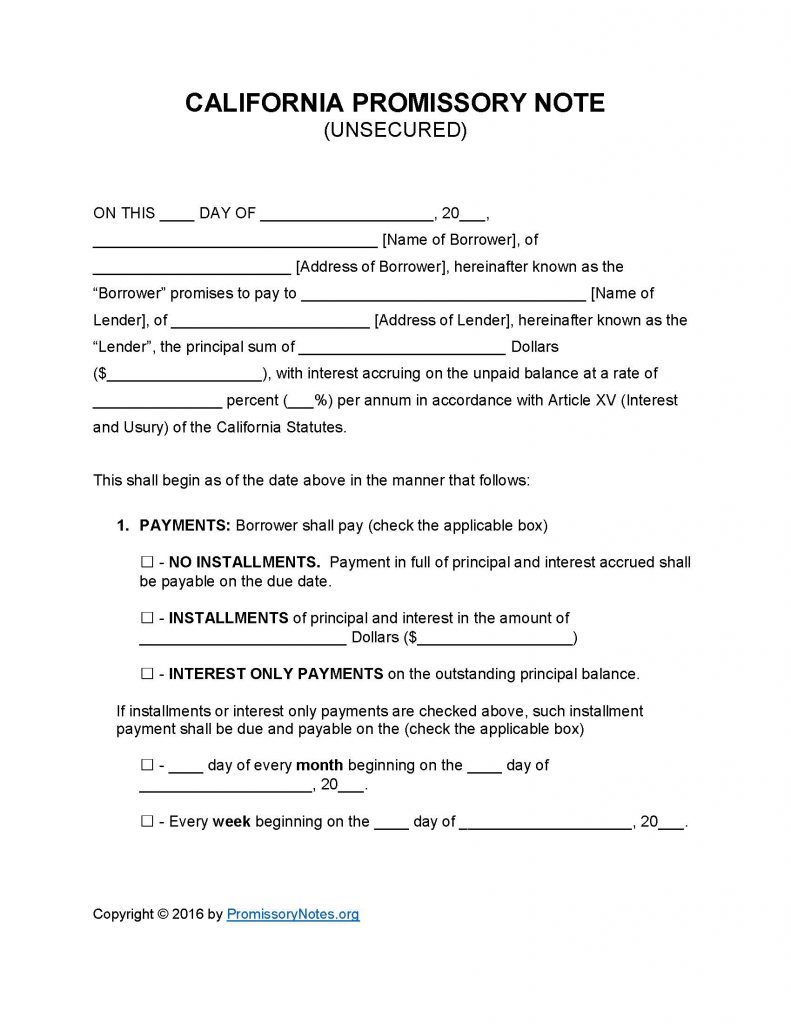

The California Unsecured Promissory Note Template can be downloaded using the .PDF/Word links on this page. Unsecured notes are a type of contract entered into by a lender and a borrower. The difference between a “secured” note and an unsecured one is that if the borrower defaults on an unsecured loan, the lender may file a civil lawsuit but since the note is not backed by collateral they might not recover the full balance. Unsecured notes are typically reserved for borrowers who have very good credit and/or a high net worth.

How to Write

Step 1 – Download the template.

Step 2 – Submit the following:

- Name of borrower

- Address of borrower

- AND

- Enter the name/address of the lender

- Enter the principal amount (USD)

- Fill in the interest rate

Step 3 – Payments: The payments subsection is where the payment method, frequency, and other details must be entered.

- Select the payment method by checking the corresponding box.

- Payment Options: Installments, No Installments, Interest Only

- If Installments or Interest Only is the payment method, select the payment frequency (weekly/monthly) and enter the frequency information (weekly/monthly due date).

Step 4 – Due Date: Enter the due date of the full balance of the note (includes interest/late fees).

Step 5 – Default: Enter the interest rate that will be applied to the balance should the borrower default on the note/loan.

Step 6 – Late Fees: Should the borrower not make a payment on time, they will have X amount of days to make a payment before being subject to any late fees.

- Fill in the late fee amount.

Step 7 – Acceleration: Enter the number of days that the borrower will have to cure a default. Should the borrower fail to cure the default within this time period, the lender may declare that the full balance of the account be due immediately.

Step 8 – Signatures:

- The note must be properly dated upon signing.

- Lender must print/sign their name.

- Borrower must print their name.

- AND

- Borrower must submit a signature.

- AND

- Witnesses must print/sign their names.

California Unsecured Promissory Note – Adobe PDF – Microsoft Word