|

Colorado Unsecured Promissory Note Template |

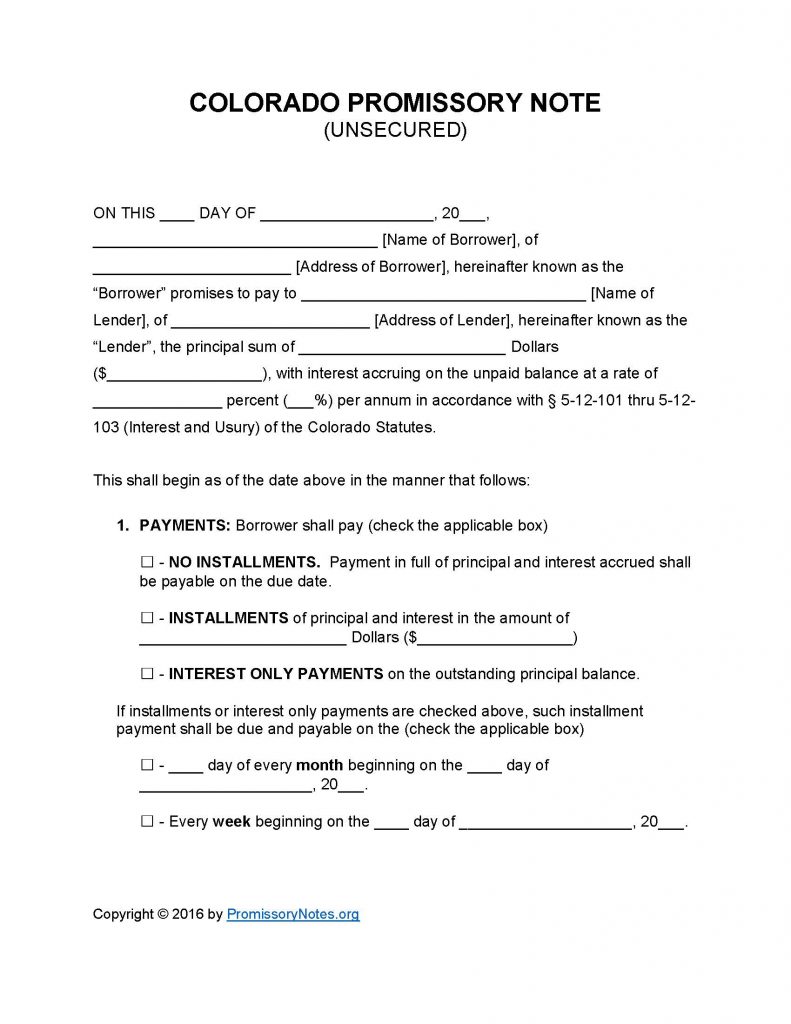

The Colorado Unsecured Promissory Note Template is available for download in .PDF or Word format. Unsecured promissory notes differ from secured notes in that they do not have the backing of the borrower’s collateral. Therefore if the borrower defaults, the lender will need to file a judgement against the borrower in order to satisfy the unpaid balance. If the borrower does not have the means to repay the loan, the lender will take a loss. Unsecured notes/loans are typically reserved for borrowers who have high credit ratings (or are otherwise deemed “low risk”).

How to Write

Step 1 – Download the file.

Step 2 – Submit the following details in the first paragraph of the note:

- Date

- Name of borrower

- Address of borrower

- Name of lender

- Address of lender

- AND

- Principal amount

- Interest rate (interest rate must be compliant with Colorado statutes regarding usury rates)

Step 3 – Payments:

- Select the payment method by checking the corresponding box on the left side of the page.

- Weekly/monthly payment frequency details (i.e. the due date) must be entered if the payment method is “Installments” or “Interest Only.”

Step 4 – Due Date: The date the full sum of the balance is due.

- Enter the date into the blank input field.

Step 5 – Default:

- Fill in the interest rate that will be applied to the balance should the borrower default.

Step 6 – Late Fees: This subsection details the number of days the borrower will have to make a past-due payment before the lender may issue a late fee.

- Enter the late fee amount.

Step 7 – Acceleration: Should the borrower default on the note, they will have the number of days described in this subsection to “cure” the default. If the default is not cured within the specified amount of time the lender may demand the entire balance immediately due.

Step 8 – Signatures:

- The note must be properly dated in the appropriate input fields.

- Lender must print/sign their name.

- Borrower must print/sign their name.

- AND

- Witnesses must print/sign their names.

Colorado Unsecured Promissory Note – Adobe PDF – Microsoft Word