|

Florida Secured Promissory Note Template |

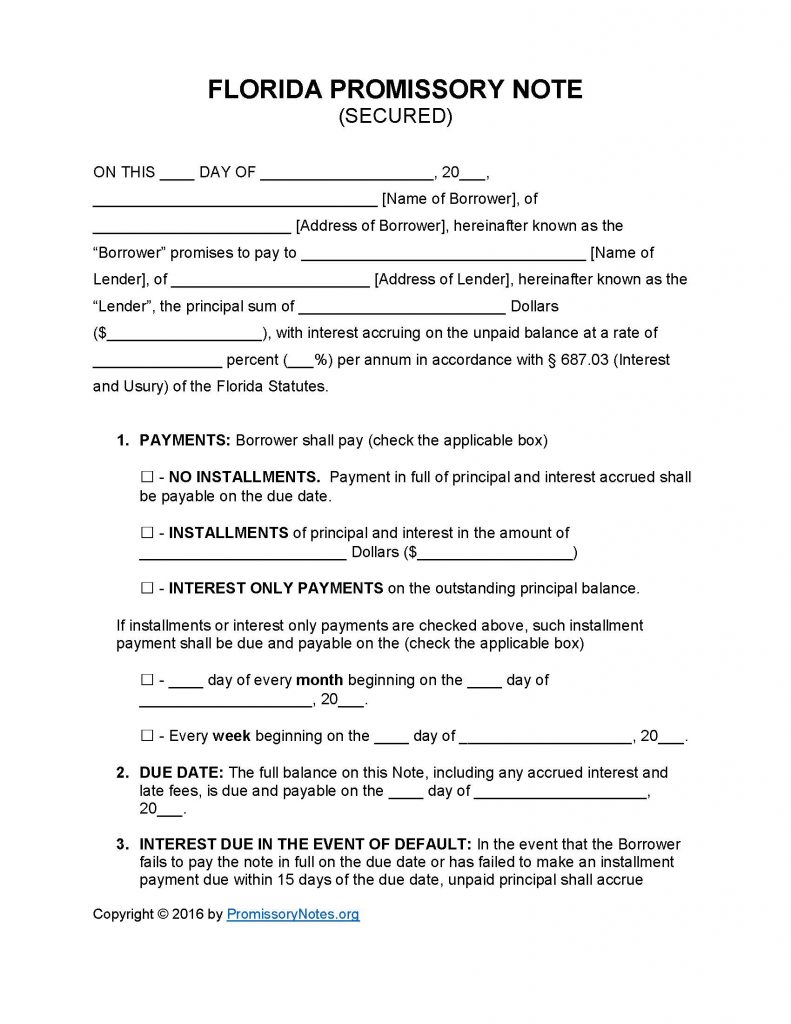

The Florida Secured Promissory Note Template is a written contract that is entered into by a lender and a borrower. The note is used to identify the specific terms of a loan (such as the principal sum, interest rate(s), payment method, payment schedule, etc.). Secured notes differ from unsecured ones in that they are “secure” due to the borrower pledging his/her assets as collateral. In the event of a default, the lender may take possession of the borrower’s assets in order for the loan to be considered paid off. Use the links on this page to download the template in .PDF or Word format.

How to Write

Step 1 – Download the template in the file format of your choice via the links near the top of the page.

Note: The .PDF can be filled out electronically.

Step 2 – On the first page of the form (in the opening paragraph) submit the following:

- Date in the appropriate format

- Full name of borrower

- Address of borrower

- Name/address of lender

- Principal sum of loan/note

- Interest rate (in accordance with F.S. Ch. 687)

Step 3 – Payments – Select a payment method (by checking the box) from the following options:

- No Installments

- Installments – enter the installment amount

- Interest Only

Step 4 – If the selected payment method is “Installments” or “Interest Only,” a payment schedule must be selected:

- Monthly – enter the monthly due date

- Weekly – submit the weekly due date

Step 5 – Interest Due in Event of Default: This subsection describes the interest rate that will be applied to the balance (should the borrower default on the note).

- Fill in the interest rate amount.

Step 6 – Late Fees: This subsection is for detailing the late fee stipulations of the contract.

- Enter the amount of days the borrower will have to make a payment (past the due date) before late fees may be applied to the balance.

- Fill in the late fee amount.

Step 7 – Security:

- Submit a description of the pledged asset(s).

Step 8 – Signatures:

- Fill in the date (in dd/m/yy format).

- Provide the name/signature of the borrower.

- Provide the name/signature of the lender.

- AND

- The witnesses must print/sign their names.

Florida Secured Promissory Note – Adobe PDF – Microsoft Word