|

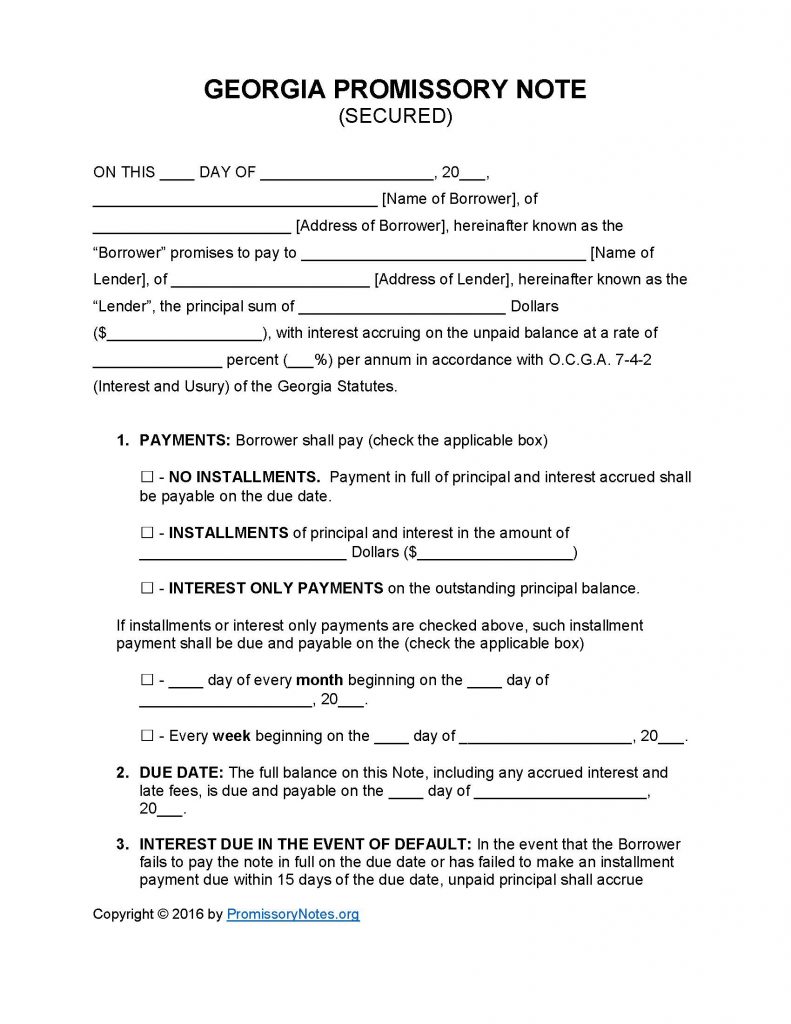

Georgia Secured Promissory Note Template |

The Georgia Secured Promissory Note Template is a legal document that is available in .PDF or Word format (via the links on this page). The document outlines the various terms of a loan (including the principal sum, interest rate, interest due in the event of default, and more). Secured notes differ from unsecured ones due to the fact that they are backed by pledged assets of the borrower. The assets serve as collateral in the event that the borrower defaults on the loan. Use the guide below for help when drafting the note.

How to Write

Step 1 – Download the template.

Step 2 – The opening paragraph of the note must contain the following:

- Legal name/address of the borrower

- Name of the lender

- Address of the lender

- AND

- Principal sum

- Interest rate per annum

Step 3 – Payments – One payment method must be chosen from the following options:

- No Installments

- Installments (include the installment amount)

- Interest Only

Step 4 – If the select payment option is “Installments” or “Interest Only” then the following details must be provided:

- Monthly due date

- OR

- Weekly due date

Step 5 – Late Fees:

- Enter the number of days that the borrower will have to make a payment (when they have missed the original due date) before the lender may apply a late fee to the due balance.

- Provide the late fee amount.

Step 6 – Acceleration:

- If the borrower defaults they will have the amount of days provided in this subsection to cure the default.

- If the borrower fails to cure the default the lender may demand the entire sum of the balance due.

Step 7 – Signatures:

- The date must be inputted into the appropriate fields.

- The lender and borrower must print/sign their names.

- AND

- The witnesses must print/sign their names.

Georgia Secured Promissory Note – Adobe PDF – Microsoft Word