|

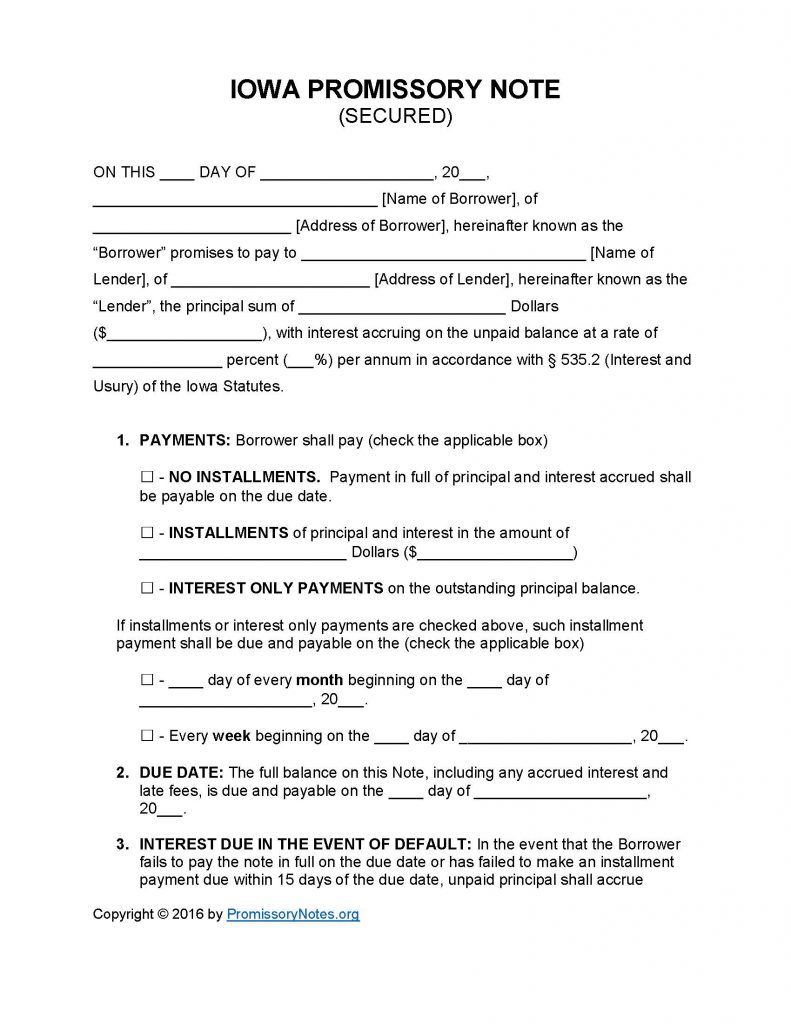

Iowa Secured Promissory Note Template |

The Iowa Secured Promissory Note Template is a type of written agreement entered into by a lender/borrower. The agreement is used to establish the terms of a loan, as well as bind the borrower to those terms. The principal sum, interest rate, payment method, and other details are covered in the document. The template may be downloaded in .PDF or Word format (the .PDF file can be compelted electronically). Use the instructions below as a guide when drafting the promissory note.

Note: This is a “secured” note – it is intended to be used for a borrower who is pledging some form of collateral in order to “secure” the loan.

How to Write

Step 1 – Download the template.

Step 2 – Enter the following information into the input fields of the first paragraph:

- Full legal name of borrower

- Borrower’s address

- Lender’s name and address

- AND

- Submit the principal sum of the note

- AND

- Enter the agreed upon interest rate

Step 3 – Payments:

- Select the payment method from the given options by checking the appropriate box.

- Enter the installment amount if applicable.

- AND

- Provide the monthly OR weekly due date information (if required).

Step 4 – Due Date:

- Fill in the final due date (when the entire balance of the principal sum including fees/interest will be due by).

Step 5 – Interest Due in Event of Default:

- Fill in the interest rate that shall be applied to the owed sum should the borrower default on the note.

Step 6 – Late Fees:

- Submit the time period that the borrower will have to make a payment (after the first due date) before the lender can apply a late fee.

- Enter the agreed upon late fee amount.

Step 7 – Acceleration:

- Provide the number of days the borrower will have to cure a default.

Step 8 – Security:

- Submit the pledged asset(s).

Step 9 – Signatures:

- Borrower AND lender must both print/sign their names.

- Witnesses are required to print/sign their names in the appropriate input fields.

Iowa Secured Promissory Note – Adobe PDF – Microsoft Word