|

Kentucky Unsecured Promissory Note Template |

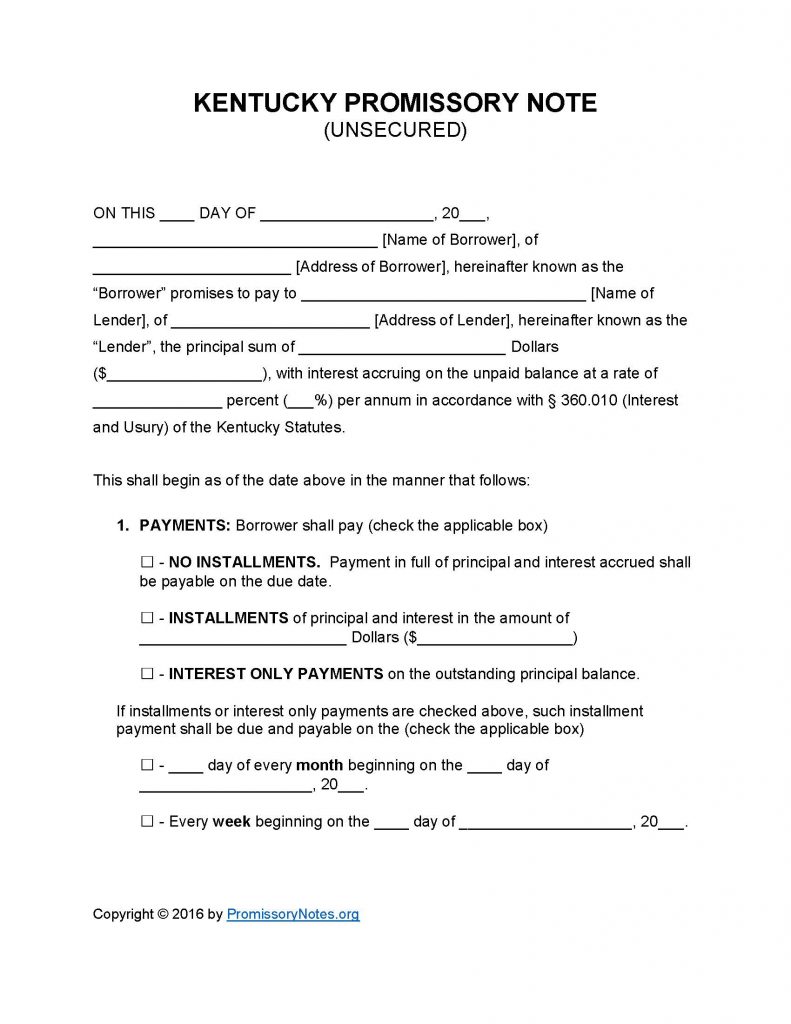

The Kentucky Unsecured Promissory Note Template is a legal document that establishes an agreement between a lender and borrower. Promissory notes are used to outline the various terms of a loan. Unsecured notes are not backed by a borrower’s pledged assets (i.e. collateral), in contrast to secured notes. The template may be downloaded in .PDF or Word format.

Note: The maximum interest rate in the State of Kentucky is 8% per annum, however certain exceptions may exist (go here for more detailed information).

How to Write

Step 1 – Download the document using the links on this page.

Step 2 – Provide the following details:

- Date (entered in dd/m/yy format)

- Name and address of borrower

- Name and address of lender

- Principal sum

- Interest rate (in accordance with KRS § 360.010).

Step 3 – Payments:

- Choose the agreed upon payment method from the available options (check the corresponding box).

Step 4 – Payments (continued):

- Provide the installment amount if necessary.

- Submit the monthly/weekly due date (if applicable).

Step 5 – Due Date:

- Provide the due date of the principal sum.

Step 6 – Interest Due in Event of Default: If the borrower defaults on the note/loan and fails to cure the default, they will be subject to the interest rate submitted in this subsection.

- Provide the interest rate.

Step 7 – Late Fees:

- If the borrower misses a payment, they will have X number of days to make the payment before the lender may apply a late fee to the balance (“X” being the number entered in this subsection).

- Provide the late fee amount that has been agreed upon by the lender/borrower.

Step 8 – Acceleration:

- Submit the number of days the lender will provide the borrower to cure a default on the note/loan.

Step 9 – Signatures:

- Submit the date.

- Submit the name of the lender/borrower.

- The borrower is required to sign the document.

- Lender must sign the document.

- Witnesses are obligated to print/sign their names.

Kentucky Unsecured Promissory Note – Adobe PDF – Microsoft Word