|

New Hampshire Unsecured Promissory Note Template |

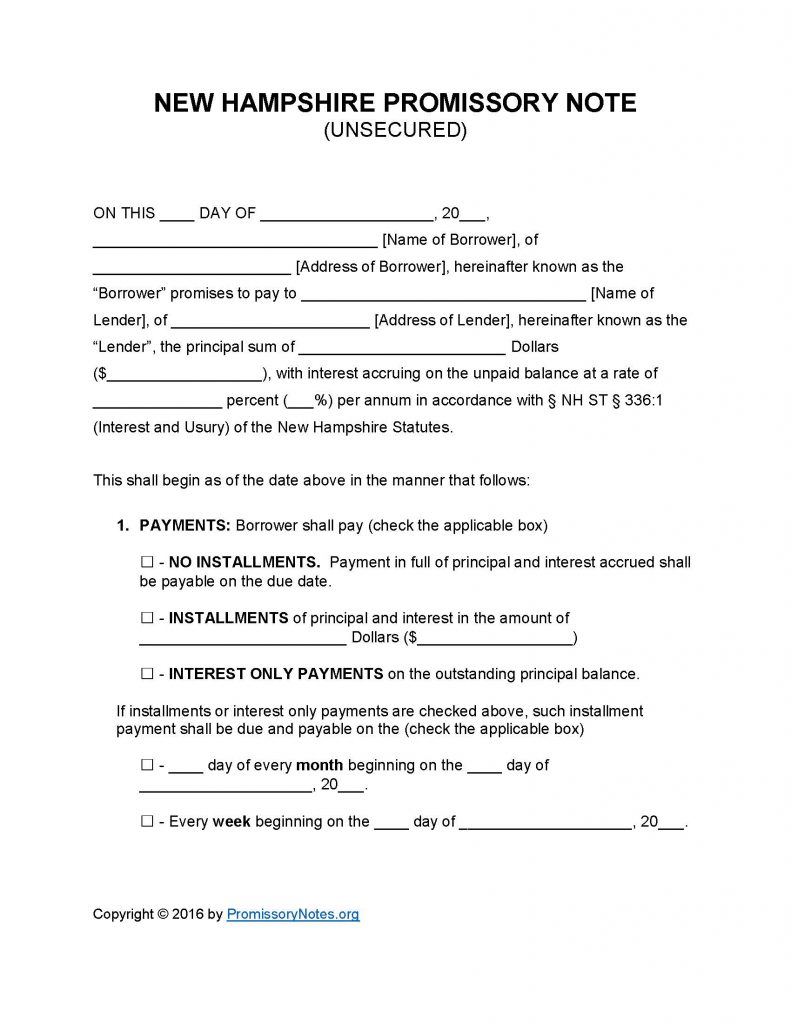

The New Hampshire Unsecured Promissory Note Template is designed for drafting an unsecured note for use in the State of New Hampshire. Unsecured notes, in direct contrast to secured notes, do not require that the borrower pledge collateral in exchange for receiving a loan. In the event of default, the lender’s only recourse with an unsecured note is to file a civil suit against the borrower. For this reason, lenders typically only enter into an unsecured note with borrowers who have stellar credit.

How to Write

Step 1 – Download the document.

Step 2 – The first paragraph of the template needs to be filled in with the following information:

- Date

- Name and address of borrower

- Name/address of lender

- AND

- The principal sum must be provided

- The interest rate must be submitted

Step 3 – Payments – Choose the payment method the borrower has chosen (from the following list):

- No Installments

- Installments

- Interest Only

Step 4 – The following details must be provided (if the borrower’s payment method is either “Installments” or “Interest Only”):

- Installment amount

- Monthly payment frequency/weekly payment frequency

Step 5 – Due Date – The entire sum of the note will be due by the date entered into this subsection:

- Provide the due date in the given format.

Step 6 – Interest Due in Event of Default:

- Should the borrower default on the loan, they will be required to pay the interest percentage as described in this subsection.

Step 7 – Late Fees:

- After missing a payment, the borrower shall have the number of days submitted in this subsection to pay the balance that is due.

- If the borrower misses the aforementioned “grace” period, they will need to pay a late fee – submit the late fee amount.

Step 8 – Acceleration:

- Provide the number of days the borrower has to cure a default on the note. If the borrower does not cure the default within the time period mentioned in the subsection, the lender may take further action (e.g. civil lawsuit, etc.).

Step 9 – Signatures:

- Fill in the date.

- Print the names of the parties (borrower, lender, witnesses).

- ALL parties must sign their names in the appropriate input fields.

New Hampshire Unsecured Promissory Note – Adobe PDF – Microsoft Word