|

Oregon Secured Promissory Note Template |

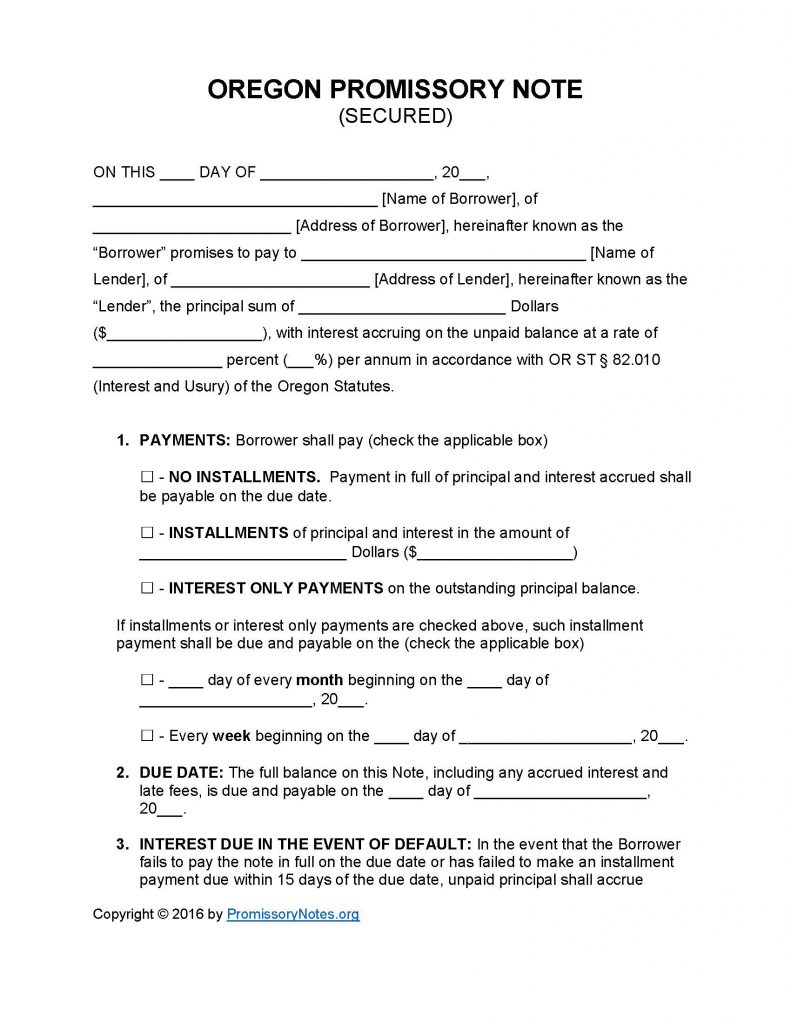

The Oregon Secured Promissory Note Template is a legal form that is designed to be used when drafting a secured promissory note. Secured notes, in contrast to unsecured ones, require the backing of security (i.e. collateral). The instructions posted below are intended to be a guide on how to properly draft the note.

Note: Once the template has been filled out, it must be signed by the borrower, lender, and witnesses.

How to Write

Step 1 – Download the form.

Step 2 – Fill in the following details into the corresponding input fields (of the first paragraph):

- Date

- Name/address of borrower

- Name/address of lender

- Principal sum of loan

- Interest rate

Step 3 – Payments – Provide the following information:

- Payment method (“No Installments” – “Installments” – “Interest Only”)

- Installment amount (if “Installments” is the chosen method)

- Due date (if “Installments” OR “Interest Only” is the selected method)

Step 4 – Due Date:

- Fill in the date in which the full balance of the note must be paid off by.

Step 5 – Interest Due in Event of Default:

- Submit the interest rate that shall be applied to the balance of the loan (in the event of a default).

Step 6 – Late Fees:

- Enter how long the borrower will have, after missing a scheduled installment, to make a payment.

- If the borrower does not make the payment within the specified number of days, the lender can apply a late fee to the balance.

Step 7 – Acceleration:

- After the borrower has defaulted on the loan, they will have X amount of days to cure the default.

- Provide how long the borrower will have after defaulting on the loan.

Step 8 – Security:

- Fill in a description of the security.

Step 9 – Signatures:

- Enter the date.

- Submit the names of the borrower, lender, and witnesses.

- The borrower, lender, and witnesses are required to submit their signatures.

Oregon Secured Promissory Note – Adobe PDF – Microsoft Word