|

West Virginia Unsecured Promissory Note Template |

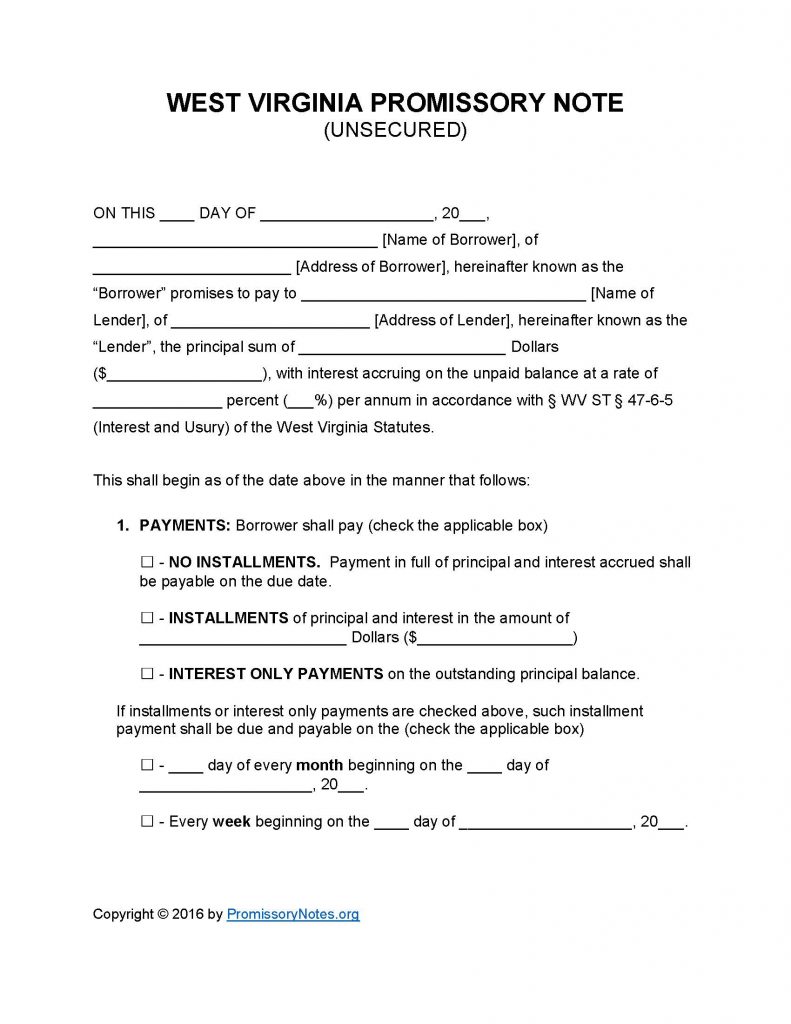

The West Virginia Unsecured Promissory Note Template can be used to create an unsecured note (which is essentially a type of loan agreement). Promissory notes outline the terms of a loan, and create a written record of the agreement between lender/borrower. Notes are legally enforceable documents (only if they have been drafted properly, and signed by the involved parties). Follow the guide posted below to learn how to use the template to create a legally valid promissory note.

How to Write

Step 1 – Download the document.

Step 2 – The note’s first paragraph must contain the following:

- Date of note

- Names of borrower/lender

- Addresses of borrower/lender

- Principal sum

- Interest percentage (per annum)

Step 3 – Payments – Provide the following payment details:

- Method (check the appropriate box)

- Payment amount AND schedule – if applicable

Step 4 – Due Date:

- Enter the due date of the principal sum.

Step 5 – Interest in Event of Default:

- In the event of a default on the loan, the borrower will be required to pay the interest rate submitted in this subsection.

Step 6 – Late Fees:

- Submit the number of days, after missing a payment, the borrower will have to bring the account current.

- Submit the late fee that will be charged if the borrower does not make the payment in time.

Step 7 – Acceleration:

- The borrower, after defaulting on the loan, must bring the account current else face further action from the lender. Submit how long the borrower will have to bring the account current.

Step 8 – Signatures:

- Enter the date.

- Provide the names of the borrower, lender, and witnesses.

- The parties must sign their names in the appropriate sections.

West Virginia Unsecured Promissory Note – Adobe PDF – Microsoft Word