|

Wisconsin Unsecured Promissory Note Template |

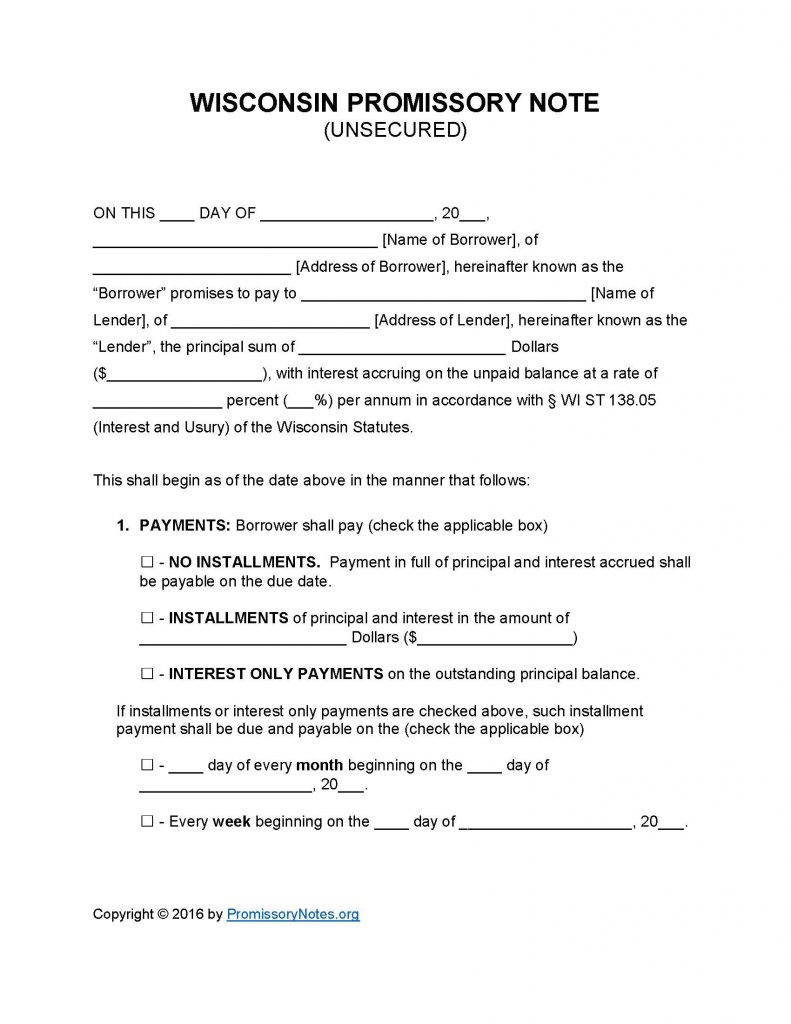

The Wisconsin Unsecured Promissory Note Template was created to be used as a starting point when drafting an unsecured note. Unsecured notes, in direct contrast to secured notes, do not require the borrower to pledge collateral. The template posted on this page should only be used to draft an unsecured note. If you need a secured template, go to the main page to download one. Otherwise, follow the instructions posted below to properly draft/format your template into a legally valid note.

How to Write

Step 1 – Use the links at the top of the page to download the template.

Step 2 – The first paragraph (on page one) should contain the following:

- Date (dd/m/yy format)

- Name of borrower

- Address of borrower

- Name/address of lender

- Principal sum of note

- Interest percentage (per annum)

Step 3 – Payments: Choose the payment method the borrower has agreed to use by checking the appropriate box.

- If applicable, enter the installment amount AND monthly/weekly payment schedule.

Step 4 – Due Date:

- Submit the final due date of the note.

Step 5 – Interest Due in Event of Default:

- Enter what interest rating the borrower will be required to pay if they default on the loan.

Step 6 – Late Fees:

- The borrower must make a past-due payment within the number of days submitted in this subsection, else they will be charged with a late fee.

- Submit the late fee amount.

Step 7 – Acceleration:

- Fill in how long (in days) the borrower will have to cure a default on the note.

Step 8 – Signatures:

- Enter the date in dd/m/yy format.

- The printed names of the borrower, lender, and witnesses must be submitted.

- The signatures of the borrower, lender, and witnesses must be entered.

Wisconsin Unsecured Promissory Note – Adobe PDF – Microsoft Word