|

Alaska Secured Promissory Note Template |

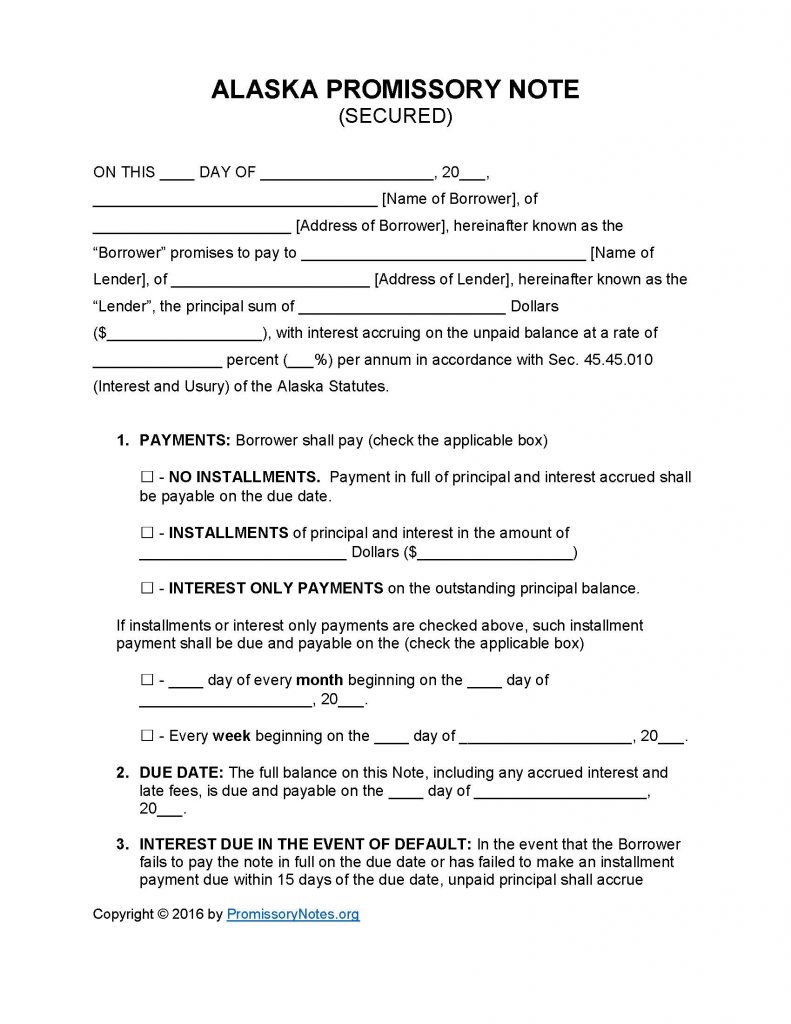

The Alaska secured promissory note is a legally binding document that allows a borrower to offer collateral in order to “back” the loan. The note also outlines the various terms of the loan. Lenders typically prefer secured notes over “unsecured” notes when lending to a borrower that is considered to be at risk of nonpayment. If the borrower defaults, the asset(s) that the were pledged may be sold in order to pay the for the loan, or the lender may take possession of them.

If the borrower satisfies the loan in accordance with the terms of the agreement, the lender must provide the borrower with a written statement releasing them of any further obligation. This document must be signed by at least two witnesses in order to be legally binding.

How to Write

Step 1 – Download the template via the links on this page. The template can be downloaded in .PDF or Word format.

Step 2 – The first section must contain the following:

- Date (day, month, year)

- Full name of borrower

- Full address of borrower

- Name of lender

- Address of lender

- Amount of the principal

- Accruing interest rate

- Interest rate in accordance with A.S. 45.45.010-.070

Step 3 – Payments:

Check the box that corresponds to the type of payment method that the borrower will be required to follow (installments/no installments/ interest only).

If the payment method is “Installments” or “Interest Only,” select the payment details:

- Monthly payment (fill in the monthly date)

- Weekly payments (fill in the weekly date)

Step 4 – Due Date:

- The date that the full balance of the note would be due (including interest/late fees).

- Date must include the day, month, and year.

Step 5 – Default:

- Fill in the interest rate that the borrower would be subject to should they default on the note.

Step 6 – Late Fees:

- Enter the amount of time (in days) that the borrower will have before the lender issues a late fee. The late fee will be included with the scheduled payment.

Step 7 – Acceleration:

- Fill in the number of days that the borrower will have to “cure” a default. If the borrower does not pay the amount before this time period has lapsed the lender may declare that the outstanding balance be due immediately.

Step 8 – Security:

- Provide a description of the collateral (“secured property”).

Step 9 – Signatures:

- Fill in the date (dd/mm/yyyy format).

- Borrower must print/sign their name.

- Lender must print/sign their name.

- Two witnesses must print/sign their names.

Alaska Secured Promissory Note – Adobe PDF – Microsoft Word