|

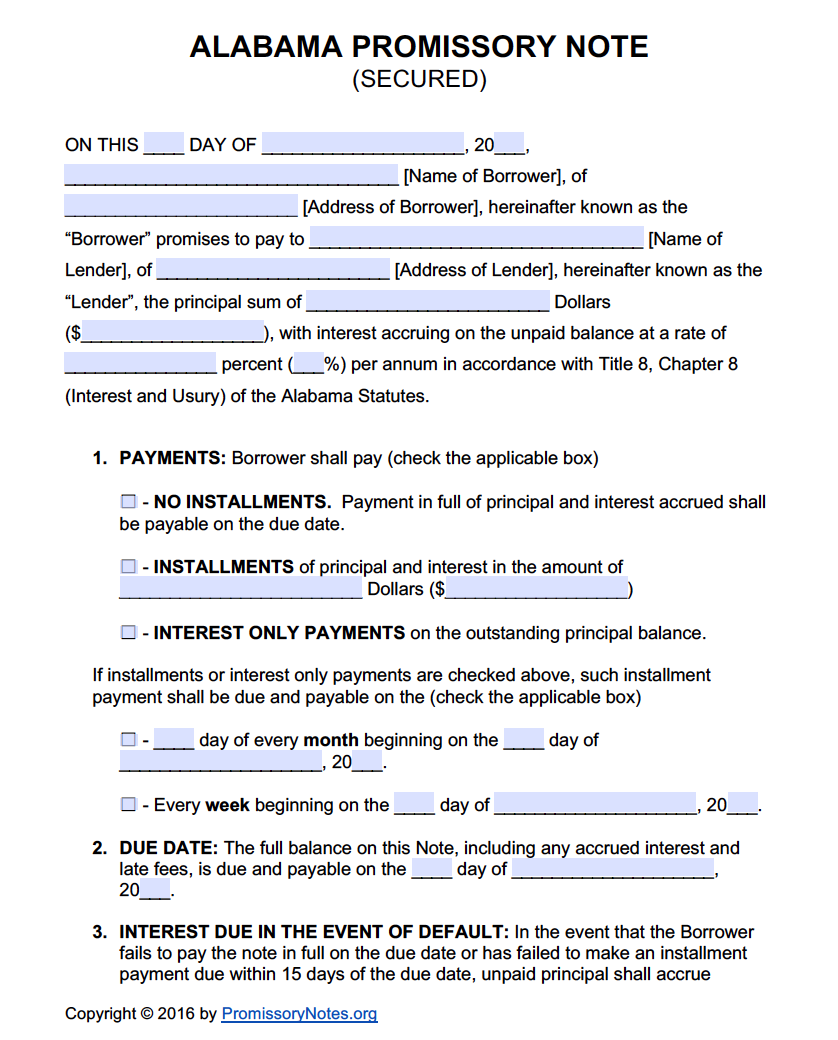

Alabama Secured Promissory Note Template |

The Alabama secured promissory note is a document that serves as a written contract between two parties, a lender and borrower; whereas the lender will provide a monetary loan to the borrower while the borrower provides personal property as security, in the event they default on the loan. Should this be the case, the lender would then be within their legal rights to take possession of the property provided by the borrower, to retain or sell in order to retrieve the amount of the loan.

Otherwise, when the monetary loan is satisfied in accordance to the agreement, the lender would then be obligated to return the property and provide a written release of any further liability or obligation to the lender. This document will require the signature of two witnesses in order that it may be effective and legally enforceable.

How to Write

Step 1 – Download the Note Form – Provide:

- The date in which the document is being executed between the parites in dd/m/yyyy format

- Enter the name of the borrower

- Borrower’s complete address

- AND

- Submit the name of the lender

- Lender’s complete address

- AND

- Submit the amount of the principal portion of the agreement

- Submit the accruing interest rate on the balance

- Enter the percentage rate (annual or APR) according to Alabama “Title 8, Chapter 8 (Interest and Usury) of the Alabama Statutes”

Step 2 – Payments – Check the box, on the form, that would best indicate method of repayment, as follows:

- No Installments (payable in full, with interest, on the due date)

- Installments – Enter the principal and interest payment amounts

- Interest Only Payments (on the principal balance outstanding)

Should “Installments” or “Interest Only Payments,” be a selection, check the following box that would be applicable:

- Monthly payments- Enter the beginning date of the agreement in dd/m/yy format

- Weekly payments – Enter the commencement date of the note (dd/m/yy)

- Due Date – Provide the date in which the full balance of the note to include interest and late fees (if there are late fees to apply); would be due – dd/m/yy format

- Interest Die in the Event of Default – Review this title and enter the interest rate and percentage annually

Step 3 – Titled Sections – Additionally, both parties must read and agree to the following:

- Allocation of Payments

- Prepayment

- Late Fees – (Submit the number of days beyond the payment date that the borrower will have, beyond the agreed payment date, before a late fee must be applied – Enter the amount of the fee to be applied (if applicable)

- Due On Sale

- Acceleration – (Provide a specific number of days in which the borrower would have to cure a loan default)

- Attorney’s Fees and Costs

- Non-Waiver

- Severability

- Integration

- Notice

- Execution

- Security – (Enter a description of the secured property)

Step 4 – Signatures –

- Enter the date in which the document is witnessed and signed by all required parties (dd/m/yy format)

- Lender’s signature

- Printed name

- AND

- Borrowe’s signature

- Printed name

- AND

- Respective Witness’ signatures

- Printed names

Alabama Secured Promissory Note – Adobe PDF – Microsoft Word