|

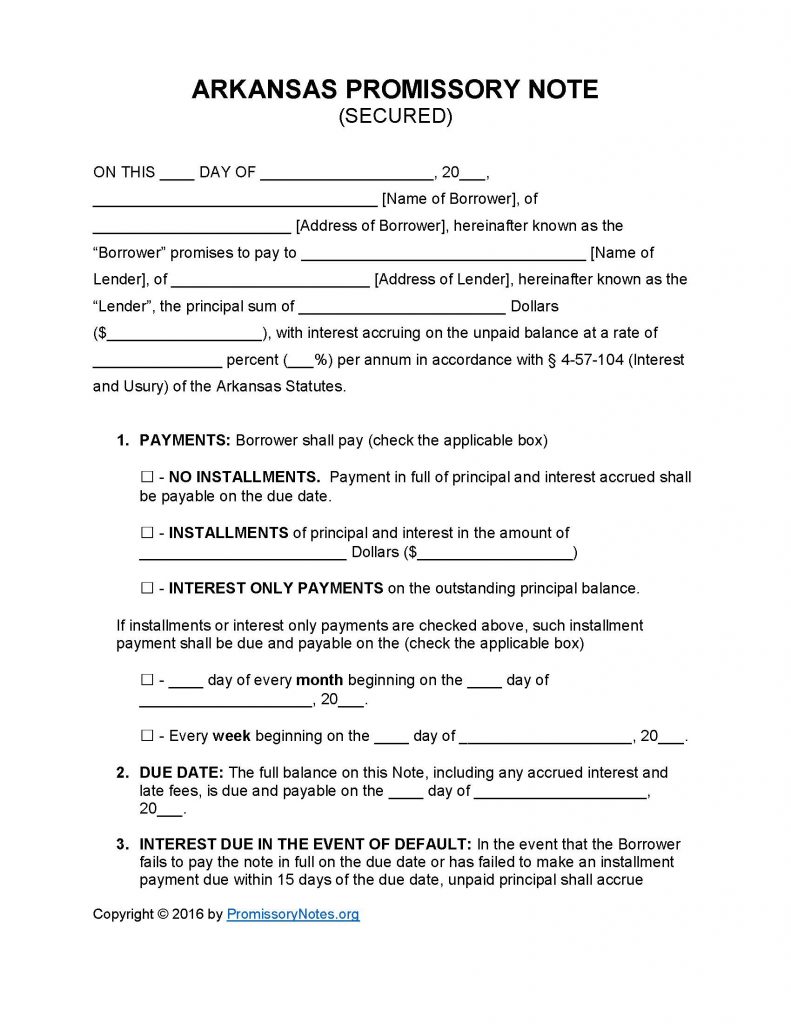

Arkansas Secured Promissory Note Template |

The Arkansas secured promissory note is a type of contract that is entered into by two parties (a lender and a borrower). The contract serves to establish the various terms of a loan (repayment method, term length, interest rate, collateral, etc.). The note is “secured” because the borrower offers collateral in order to receive the loan. If the borrower defaults on the loan, the lender has the right to take possession of the asset(s).

If the borrower pays the loan off and satisfies the terms of the contract, the lender must issue them a written statement clearing them of any further obligations.

How to Write

Step 1 – Download the document. The template can be download in .PDF or Word format.

Step 2 – In the first section enter the following details in the appropriate input fields:

- Date

- Name/address of borrower

- Name/address of lender

- Amount of loan

- Interest rate

Step 3 – Payments: Select the payment method by checking the appropriate box. If “Installments” is selected enter the amount in USD. If “No Installments” or “Interest Only” is selected the corresponding subsection must be filled out with the required information (date).

Step 4 – Due Date: Enter the date that the entire balance must be paid in full by.

Step 5 – Interest Due in Event of Default: Enter the interest rate into the input field.

Step 6 – Late Fees: Enter the amount of time (after the initial payment date) that the borrower will have to make the payment. If the borrower does not make the payment by this date they will be subject to late fees (enter the late amount).

Step 7 – Acceleration: In the event that the borrower defaults on the loan, they will have this amount of days to “cure” the default.

Step 8 – Security: Submit the asset(s) that the borrower will provide as collateral.

Step 9 – Signatures:

- Submit the date.

- Lender/borrower must both print/sign their names.

- The two witnesses are required to print/sign their names.

Arkansas Secured Promissory Note – Adobe PDF – Microsoft Word