|

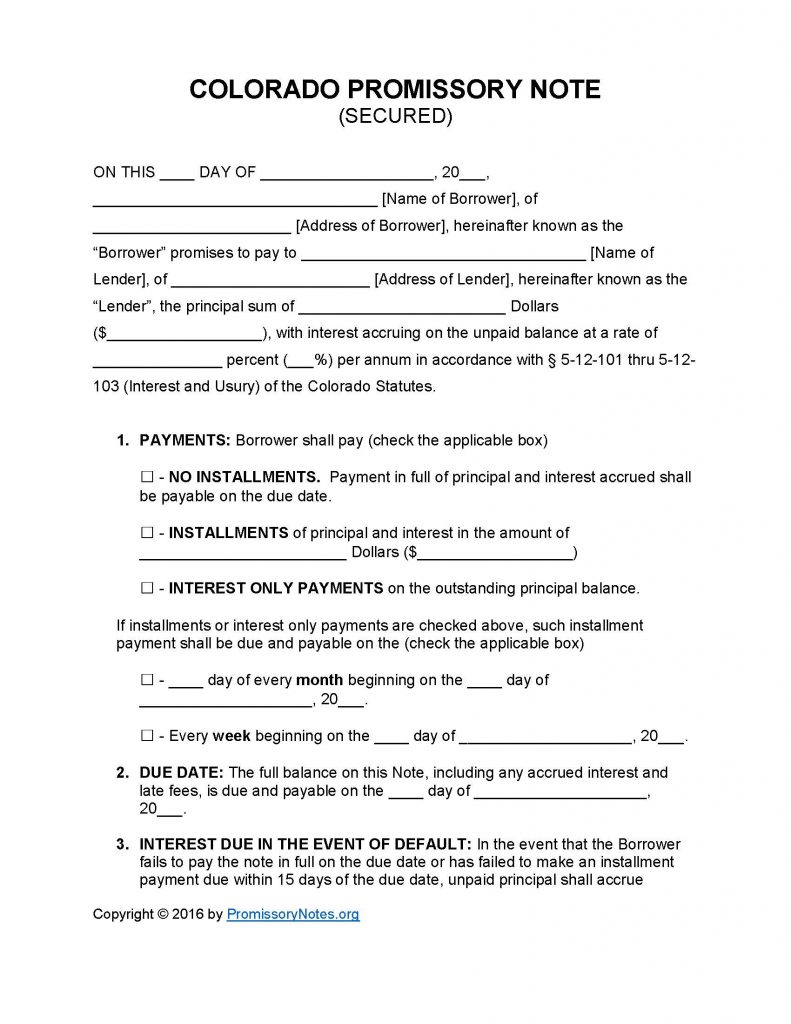

Colorado Secured Promissory Note Template |

The Colorado Secured Promissory Note Template is a contract that is used to establish the terms of a loan. The note is “secured” due to having the backing of the borrower’s pledged collateral. Should the borrower default on the note, the lender can legally take possession of the collateral in order to satisfy the unpaid balance. After the loan has been in default longer than the amount of time specified in the agreement, the lender can pursue legal action to gain possession of the collateral.

Note: Lenders will typically work with the borrower (and offer various repayment methods) before pursuing legal action to gain possession of the collateral. This is due to the inherent legal costs involved in having the collateral’s ownership transferred.

How to Write

Step 1 – Download the template via the links on this page.

Step 2 – The first paragraph of the note must contain the following:

- Full name of borrower

- Address of borrower

- AND

- Name of lender

- Address of lender

- Principal amount

- Interest rate

Step 3 – Payments: There are three payment methods that can be selected:

- No Installments

- Installments

- Interest Only

If “Installments” or “Interest Only” is the selected payment method, the payment schedule information must be filled out (weekly/monthly payment due date).

Step 4 – Due Date:

- Fill in the date the full sum of the agreement is due by.

Step 5 – Default:

- This subsection is reserved for the interest rate that will be applied to the balance if the borrower defaults on the note/loan.

Step 6 – Late Fees:

- Fill in the number of days the borrower will have to make a past-due payment. If the payment is not made within the specified number of days, a late fee will be applied to the balance.

- Submit the late fee amount.

Step 7 – Acceleration: If the borrower defaults they will have a certain number of days to cure the default. If they do not cure the default the lender can demand the entire balance be paid immediately.

- Fill in the amount in the blank input field.

Step 8 – Security:

- Submit a description of the collateral.

Step 9 – Signatures:

- The note must be dated.

- The parties must print/sign their names in the blank input fields on the last page of the note.

- Witnesses are required to print/sign their names within the “Witness” input sections.

Colorado Secured Promissory Note – Adobe PDF – Microsoft Word