|

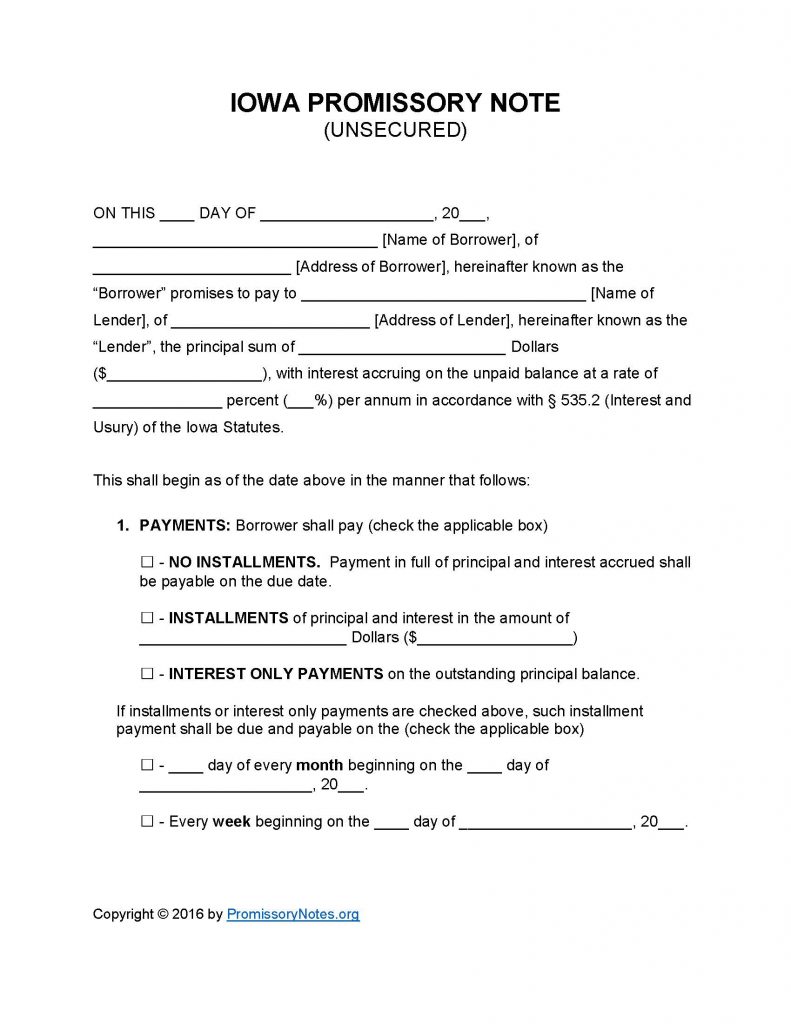

Iowa Unsecured Promissory Note Template |

Download the Iowa Unsecured Promissory Note Template in Word or .PDF format using the links posted near the top of this page. Unsecured promissory notes differ from secured notes due to the fact that they do not have any collateral (pledged by the borrower). Use the instructions posted below to learn the requirements of a note as well as how to draft one.

How to Write

Step 1 – Download the template.

Note: The .PDF template may be filled out and signed electronically.

Step 2 – The first paragraph of the note is required to contain the following information:

- Full name and address of borrower

- Name/address of lender

- AND

- Provide the principal sum/interest percentage (per annum)

Step 3 – Payment:

- Select the agreed upon payment method by checking the appropriate box from the list of options.

- If applicable – enter the installment amount.

- If required – select/provide the monthly OR weekly due date details.

Step 4 – Due Date:

- Provide the due date of the full balance (including both fees/interest).

Step 5 – Interest Due in Event of Default:

- Submit the interest percentage that the borrower will be subject to should they default on the note/loan.

Step 6 – Late Fees:

- Provide the number of days the borrower shall have after the initial due date to make a payment.

- Enter the late fee amount in the appropriate input field.

Step 7 – Acceleration:

- Submit the number of days the borrower will have to cure a default on the note/loan.

Step 8 – Signatures:

- Enter the date.

- Borrower’s name/signature must be submitted.

- Lender’s name/signature must be submitted.

- The witnesses must print/sign their names.

Iowa Unsecured Promissory Note – Adobe PDF – Microsoft Word