|

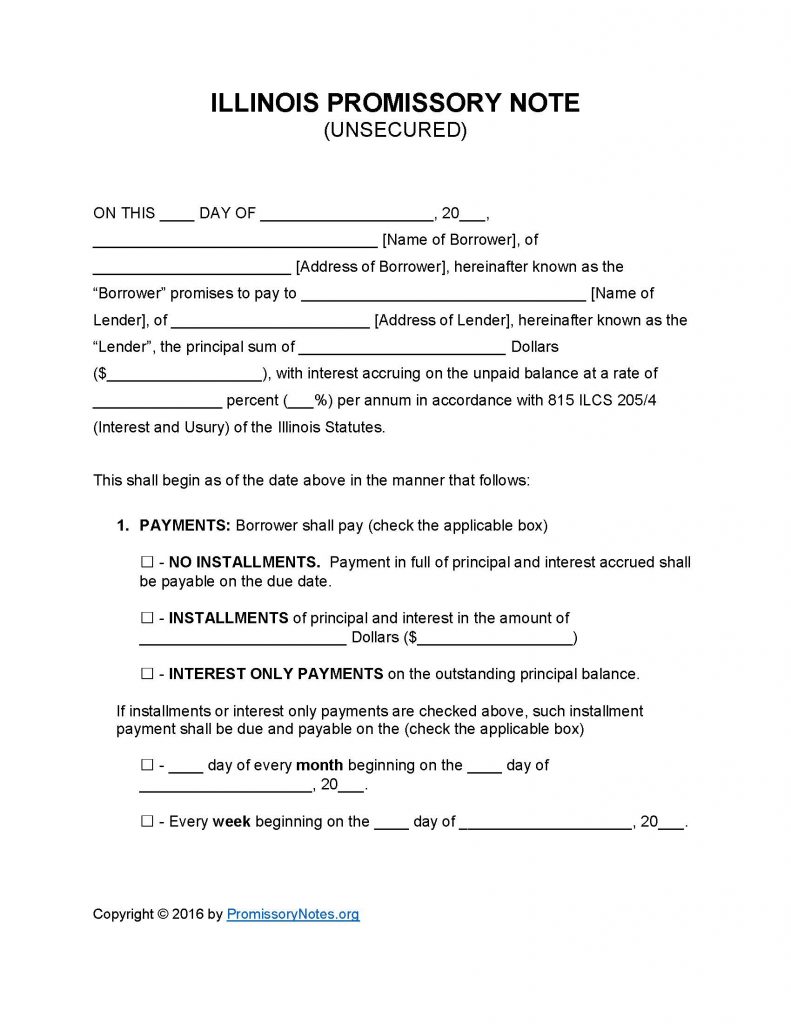

Illinois Unsecured Promissory Note Template |

The Illinois Unsecured Promissory Note Template is a legal document that is available in .PDF or Word format. Unsecured promissory notes are not backed by a borrower’s pledged assets (hence being “unsecured”). Lenders have a higher risk when using unsecured loans/notes, therefore they are typically only issued to “low-risk” borrowers. Use the instructions posted below as a guide when drafting your unsecured note.

How to Write

Step 1 – Download the file in .PDF or Word format using the links near the top of the page.

Step 2 – The document must contain the following details (within the first paragraph):

- Date

- Full name of borrower

- Address of borrower

- Lender’s name

- Address of borrower

- Principal sum

- Interest rate (per annum)

Step 3 – Payments – This subsection is used to establish the payment method, schedule, etc. Enter the following information:

- Select the payment method by checking the corresponding box.

- If the payment method is “Installments” or “Interest Only” then the monthly OR weekly payment due date must be filled in.

Step 4 – Due Date:

- Provide the final due date of the note/loan.

Step 5 – Interest Due in Event of Default:

- Fill in the interest rate that will be applied to the note/loan if the borrower defaults.

Step 6 – Late Fees:

- Submit the amount of time the borrower will have to make a payment (after the original due date has passed).

- Enter the late fee amount.

Step 7 – Acceleration: If the borrower defaults on the loan, they still have time to cure it before the lender takes further action.

- Submit the number of days the borrower will have to cure the default.

Step 8 – Signatures:

- Submit the date.

- The lender/borrower must print/sign their respective names.

- AND

- The witnesses must print/sign their names in the appropriate input sections.

Illinois Unsecured Promissory Note – Adobe PDF – Microsoft Word