|

Indiana Secured Promissory Note Template |

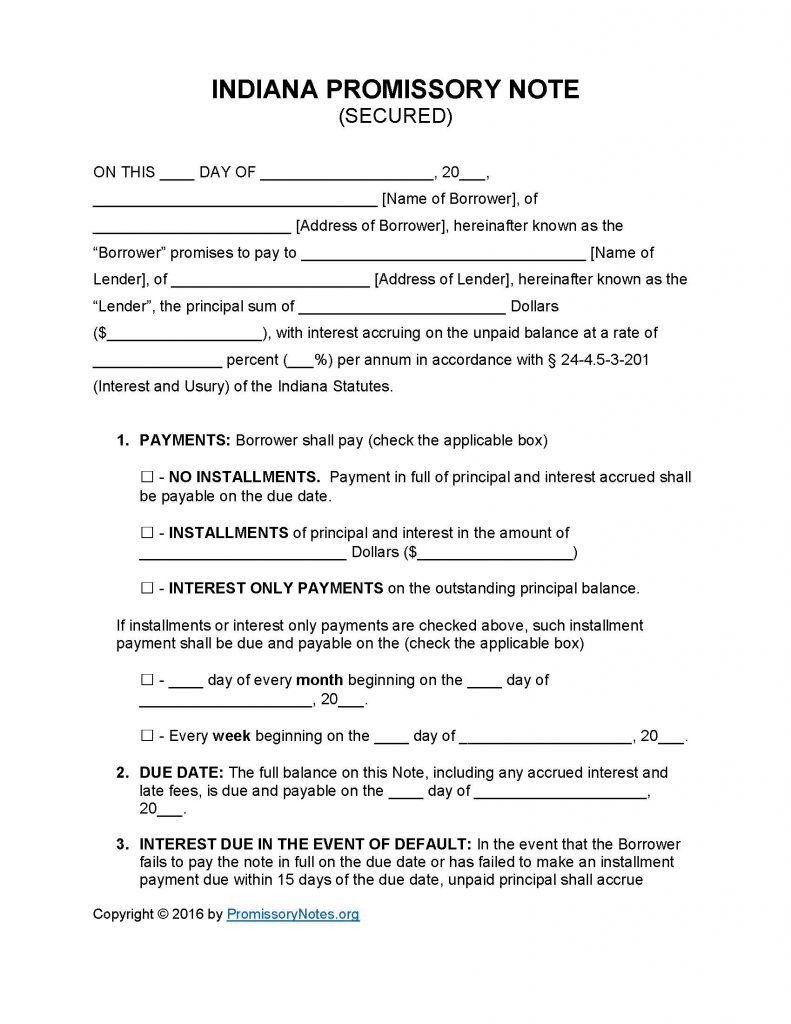

The Indiana Secured Promissory Note Template is a written agreement that is used by lenders to detail various aspects of a loan including the principal sum, interest rate, payment information (installment amount, due date, etc.), and more. The template can be downloaded using the links at the top of the page (available in .PDF and Word formats). The template is for a “secured” note, which is backed by the pledged assets of the borrower. In the event of a default, the lender can take possession of the assets.

How to Write

Step 1 – Download the file.

Step 2 – The opening paragraph of the note is required to have the following information:

- Submit the name/address of the borrower

- AND

- Enter the name of the lender

- Address of the lender

- AND

- Provide the principal sum/interest rate

Step 3 – Payments – The subsection titled “Payments” must be filled out in the following manner:

- Select the payment method by checking the box next to the agreed upon method (“No Installments,” “Installments,” OR “Interest Only”).

- Provide the installment amount (if “Installments” is the selected method).

- Select the due date (monthly OR weekly) and then enter the specific day of the month/week the payment will be due on.

Step 4 – Due Date:

- This subsection details the final due date (when the full balance of the note is due – including fees/interest).

Step 5 – Interest Due in Event of Default: If the borrower fails to make several payments, and ends up defaulting on the note/loan, an additional interest rate will be applied to the remaining balance.

- Provide the interest rate that will be applied if the borrower defaults.

Step 6 – Late Fees:

- Submit the number of days the borrower will have to make a payment (after missing the first due date) before the lender will apply a late fee to the balance.

- Submit the late fee.

Step 7 – Acceleration:

- Should the borrower default, they will have the number of days entered in this subsection to cure the default.

Step 8 – Security:

- Submit a description of the collateral.

Step 9 – Signatures:

- Provide the printed names of the lender/borrower.

- The lender/borrower must sign their names in the appropriate input fields.

- AND

- Both witnesses must print/sign their names in the allotted sections.

Indiana Secured Promissory Note – Adobe PDF – Microsoft Word