|

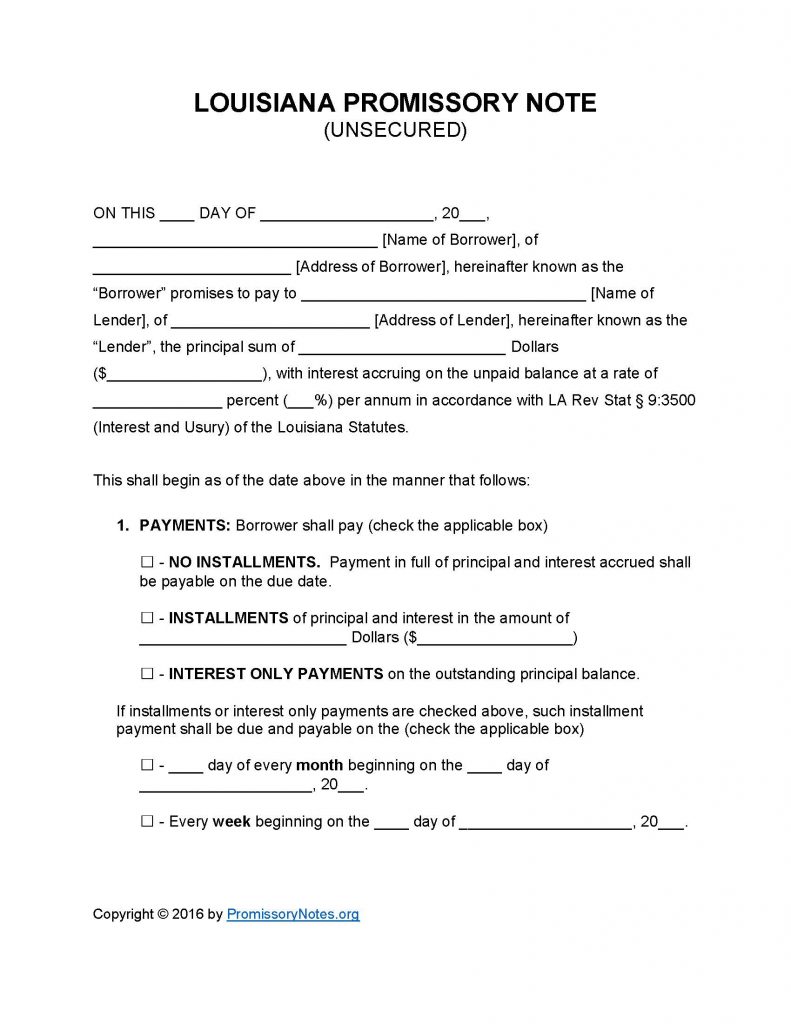

Louisiana Unsecured Promissory Note Template |

The Louisiana Unsecured Promissory Note Template is a legal form that is entered into by two parties – a lender and borrower. The document serves to establish the specific terms of a loan (e.g. principal sum, interest rate, etc.). With an unsecured note, the borrower does not pledge assets as collateral (hence being “unsecured”). The template can be downloaded in the formats provided on this page (Word or .PDF). Use the instructions below as a guide when drafting your unsecured note.

How to Write

Step 1 – Download the form using the links posted at the top of this page.

Step 2 – Provide the following details:

- Submit the date in the given format

- Name and address of borrower

- Name/address of lender

- Principal sum

- Interest rate (per annum)

Step 3 – Payments – Choose the agreed upon payment method from the list of options:

Note: Select the method by checking the box.

- No Installments

- Installments – submit the installment amount

- Interest Only

Step 4 – Provide the monthly OR weekly due date information (if the payment method is “Installments” or “Interest Only”).

Step 5 – Due Date: In this subsection provide the final due date of the principal sum.

Step 6 – Interest Due in Event of Default:

- Submit the interest rate that shall be applied to the note/loan in the event of a default.

Step 7 – Late Fees:

- Provide the amount of time the borrower shall have after missing the initial due date to make a payment. If the borrower does not make the payment within this time period, the lender can apply a late fee to the balance.

- Submit the agreed upon the late fee.

Step 8 – Acceleration:

- In the event of default, the borrower shall have the number of days as described in this subsection to cure the default.

- Provide the number of days.

Step 9 – Signatures:

- Submit the date in which the parties agree to and sign the document.

- Borrower’s name/signature

- Lender’s name/signature

- Printed names/signatures of witnesses

Louisiana Secured Promissory Note – Adobe PDF – Microsoft Word