|

Massachusetts Secured Promissory Note Template |

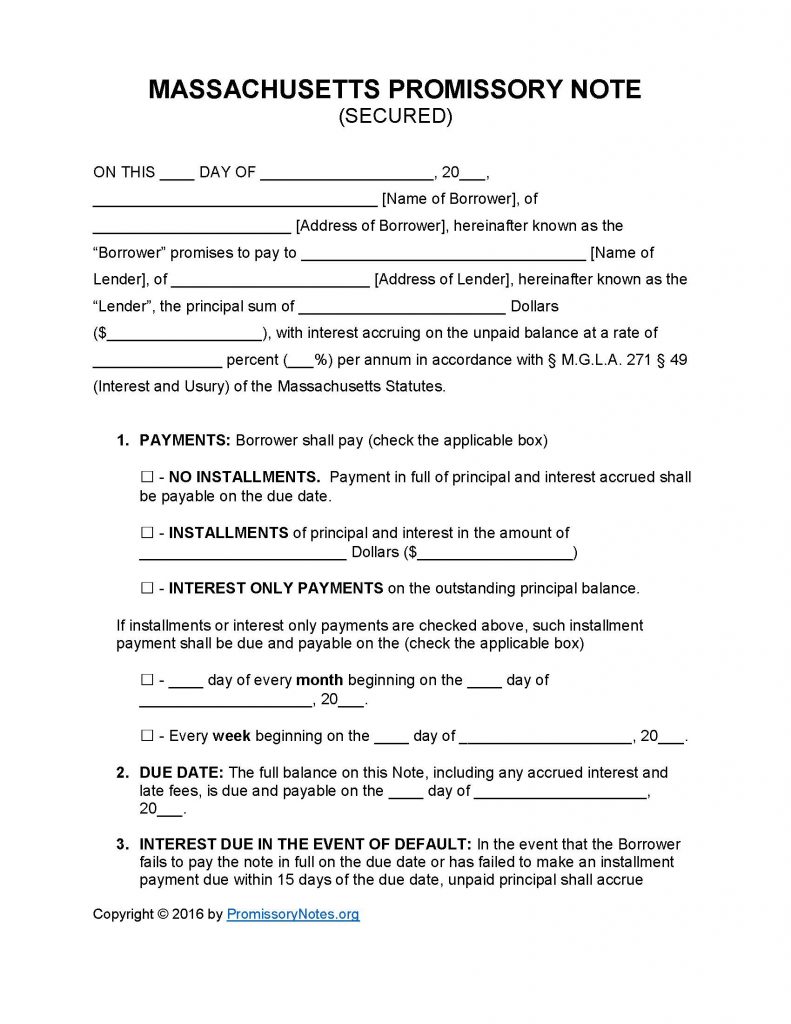

The Massachusetts Secured Promissory Note Template is intended to be used as a starting point when drafting a secured note. Secured promissory notes are a type of written agreement that is legally enforceable, entered into by a lender and borrower. The template is available for download in .PDF format (or Word). Use the instructions in the section below to learn how to fill out the template.

Usury Information: The legal rate of interest (maximum) in Massachusetts is six percent (6%). More information regarding usury laws (exceptions, etc.) can be found on this page.

How to Write

Step 1 – Download the form.

Step 2 – The first paragraph of the document is required to have the following:

- Date

- Name of borrower

- Address of borrower

- Lender’s name/address

- Principal sum

- Interest rate (in accordance with Massachusetts General Laws Chapter 107 §3)

Step 3 – Payments – Select the agreed upon payment method by checking the corresponding box:

- No Installments

- Installments – installment amount must be submitted

- Interest Only

Step 4 – The monthly/weekly installment date must be provided if the chosen method is “Installments” or “Interest Only.”

- Submit the due date information in the appropriate input fields.

Step 5 – Due Date:

- Enter the due date of the principal sum in dd/m/yy format.

Step 6 – Default:

- This subsection details the interest rate that the lender may apply to the account if the borrower defaults on the loan/note.

- Submit the agreed upon interest percentage.

Step 7 – Late Fees:

- Provide the number of days the borrower will have to make a payment (after the agreed upon due date has passed).

- If the borrower does not make the payment within this specified time period, the lender can charge a late fee. Submit the late fee amount in the appropriate input section.

Step 8 – Acceleration:

- Enter how many days the lender will give the borrower to “cure” a default.

Step 9 – Security:

- Submit the pledged asset(s).

Step 10 – Signatures:

- Provide the date

- Submit the names of the lender, borrower, and witnesses.

- The lender, borrower, and witnesses must sign their names in the allotted input sections.

Massachusetts Secured Promissory Note – Adobe PDF – Microsoft Word