|

Massachusetts Unsecured Promissory Note Template |

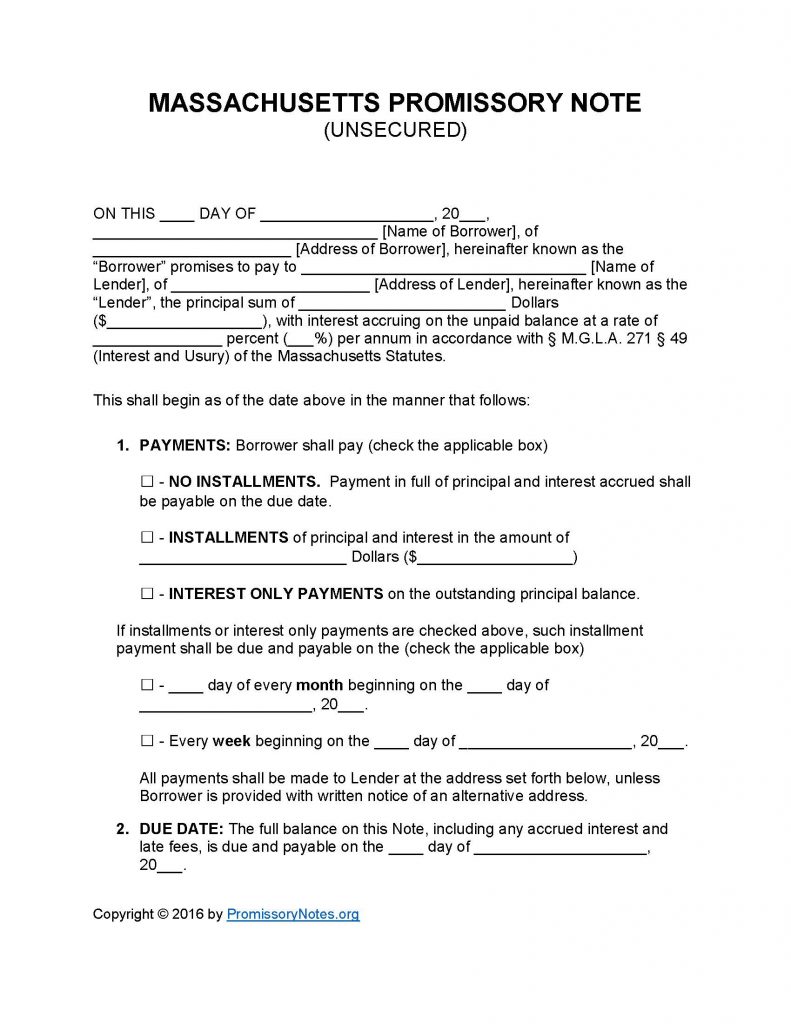

Download the Massachusetts Unsecured Promissory Note Template in the file formats provided on this page (download links located at the top of the page). The template is designed to be used as a starting point when drafting a promissory note. The template outlines the required terms of a note (parties, principal sum, interest rate, payment method, etc.). The difference between an unsecured note and a secure one is that unsecured notes are not backed by the collateral of a borrower. If the borrower defaults, the only way the lender can attempt to recoup the loan is by filing a civil suit.

How to Write

Step 1 – Download the template.

Step 2 – Provide the following details:

- Full legal names of borrower/lender

- Addresses of borrower/lender

- Principal sum of note/loan

- Interest rate percentage

Step 3 – Payments:

- The payment method may be one of three options (“No Installments” – “Installments” – “Interest Only”).

- If the payment option is either “Installments” OR “Interest Only” additional information is required.

- Submit the payment due date in monthly OR weekly format.

Step 4 – Due Date:

- Submit the due date as required by the form.

Step 5 – Interest Due in Event of Default:

- This subsection details the interest percentage that the lender will apply to the principal sum IF the borrower defaults on the note/loan.

- Submit the agreed upon interest rate.

Step 6 – Late Fees:

- Provide how many days the borrower will have to make a payment after they have missed the original due date.

- AND

- Submit the agreed upon late fee amount.

Step 7 – Acceleration:

- Enter how many days the borrower will have to cure a default on the note/loan. If the borrower does not cure the default within this time frame, the lender has the right to take further action.

Step 8 – Signatures:

- Provide the date of signing.

- The names of ALL parties must be submitted.

- The parties must sign their names in the appropriate input fields.

Massachusetts Unsecured Promissory Note – Adobe PDF – Microsoft Word