|

Maine Secured Promissory Note Template |

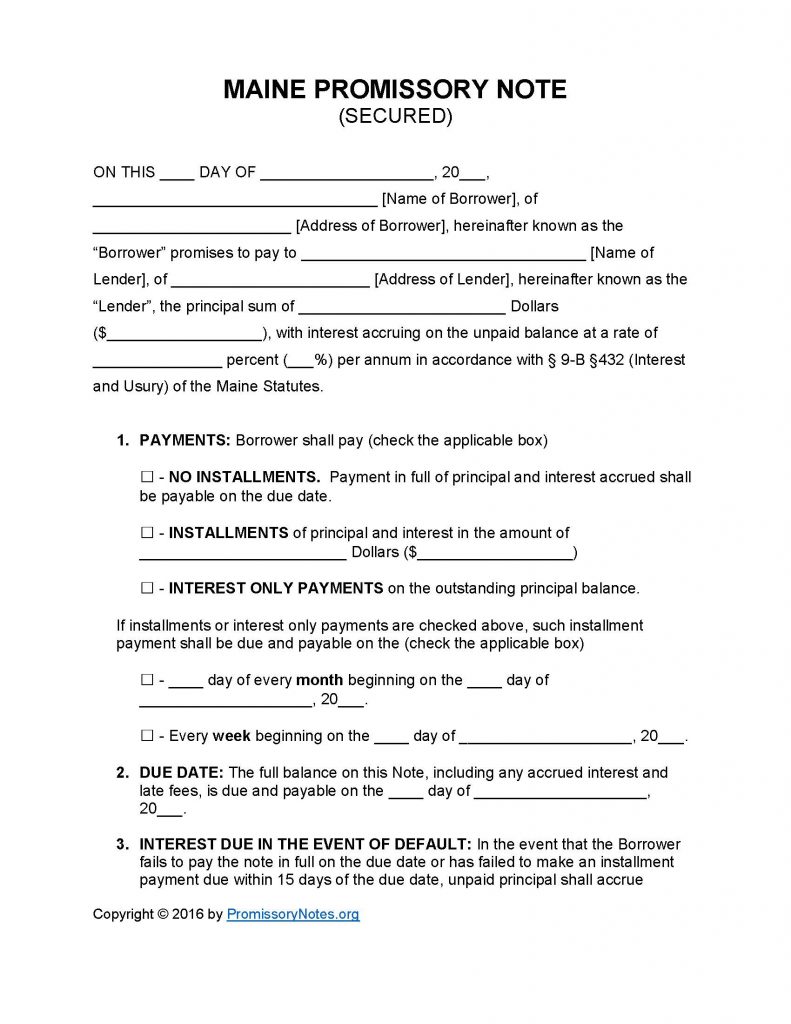

The Maine Secured Promissory Note Template is an interest-bearing agreement that is legally enforceable. Secured promissory notes are a type of agreement that lenders use to establish the terms of a loan. The borrower must sign the document before they can receive the monetary loan from the lender. The borrower must also pledge collateral as well. If the borrower defaults on the note and does not cure the default, the collateral can legally become the property of the lender.

How to Write

Step 1 – Download the template using the links at the top of the page.

Step 2 – In the opening paragraph submit the following details:

- Date in dd/m/yy format

- Name of borrower

- Address of borrower

- Lender’s name/address

- Principal sum

- Agreed upon interest rate

Step 3 – Payments – Select the payment method from the available options (“No Installments” – “Installments” – “Interest Only”).

- If the agreed upon payment method is “Installments” enter the installment amount.

- If the payment method is either “Installments” or “Interest Only” submit the monthly OR weekly due date.

Step 4 – Due Date:

- Provide the due date of the full principal sum (in addition to fees/interest).

Step 5 – Late Fees:

- Provide the number of days the borrower will have to pay a past-due bill before the lender will add a late fee to the balance.

- Submit the agreed upon late fee.

Step 6 – Acceleration:

- Provide the period of time that the borrower will have after defaulting on the note to “cure” the default.

Step 7 – Signatures – Submit the following required details:

- Date of signing

- Names of lender/borrower/witnesses

- AND

- Borrower must sign the document.

- Lender must sign their name.

- Witnesses must sign the form.

Maine Secured Promissory Note – Adobe PDF – Microsoft Word