|

Maine Unsecured Promissory Note Template |

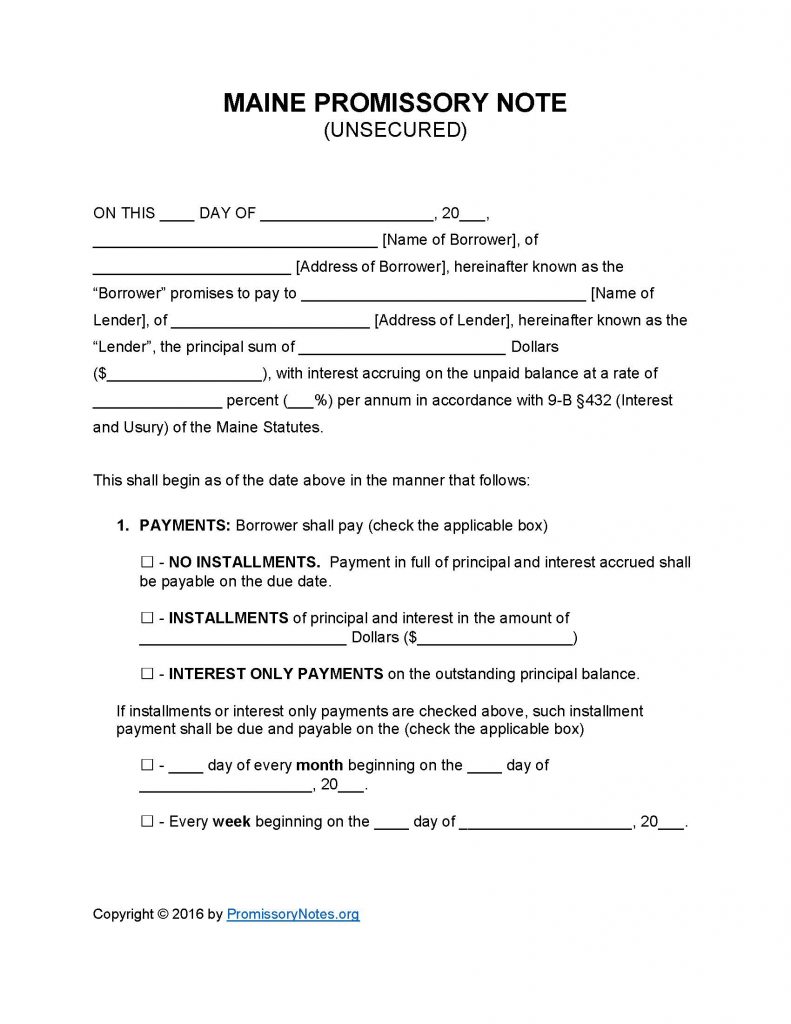

The Maine Unsecured Promissory Note Template is an agreement that lenders use to detail the various terms of a loan such as the principal sum, interest rate, installment/payment information, etc. Unsecured notes differ from secured notes in that they are not backed by the collateral of the borrower. Unsecured notes or loans are usually reserved for use with borrowers who are considered “low risk.” The instructions posted below detail the required content of the note.

How to Write

Step 1 – Download the template in .PDF or Word format.

Step 2 – Provide the following details within the opening paragraph of the document:

- Date of agreement

- Name of borrower

- Signature of borrower

- Name of lender

- Signature of lender

- AND

- Principal sum of note/loan

- Interest rate (in accordance with Maine Revised Statutes Title 9-A)

Step 3 – Payments – Select the payment method:

- No Installments

- Installments – submit the agreed upon installment amount

- Interest Only

Step 4 – Enter the monthly/weekly due date if the payment method is either “Installments” or “Interest Only.”

Step 5 – Due Date:

- Provide the final due date of the note (when the entire balance/sum is due by).

Step 6 – Interest Due in Event of Default:

- Submit the interest rate that shall be applied to the balance if the borrower defaults on the note.

Step 7 – Late Fees:

- Provide the agreed upon late fee amount.

- AND

- Submit the period of time the borrower will have to make a past-due payment before the late fee is applied to the balance.

Step 8 – Acceleration:

- If the borrower defaults on the loan they will have a certain amount of time to cure the default before the lender can take further action (by filing a civil suit, etc.).

- Provide the period of time the borrower will have to cure the default.

Step 9 – Signatures:

- Provide the date of signing.

- Submit the printed names of the lender, borrower, and witnesses.

- The borrower, lender, and witnesses must sign their names in the appropriate input fields.

Maine Unsecured Promissory Note – Adobe PDF – Microsoft Word