| Minnesota Promissory Note Templates |

The Minnesota promissory note templates serve as written agreements that are used to outline the principal sum, interest rate, borrower/lender, repayment schedule/frequency, and other terms of a loan. Promissory notes can be secured or unsecured – with secured notes being backed by collateral pledged from the borrower. The collateral serves as security in the event of default. If the borrower defaults on the loan, the lender can take possession of the collateral. Unsecured notes are typically issued with higher interest rates due to their inherent greater risk. Use the links provided on this page to download the templates in your choice of format (available in either .PDF or Word format).

Usury Rate – Under § 334.01 the maximum rate of interest is eight percent (8%) per annum for written contracts, unless for an amount over $100,000, in which case there is no limit.

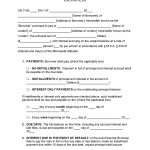

Minnesota Secured Promissory Note Template

The Minnesota Secured Promissory Note Template is a legal document used to detail the principal sum, interest rate, payment method, and other facets of a loan. The borrower is required to pledge collateral when signing the secured promissory note. The reason for this is that in the event of a default on the note/loan, the lender […]

Minnesota Unsecured Promissory Note Template

Use the links near the top of the page to download the Minnesota Unsecured Promissory Note Template. The template is designed to be used when drafting an unsecured promissory note (for use in the State of Minnesota). Unsecured notes, in contrast to secured ones, do not require that the borrower pledge collateral (in order to […]