|

Minnesota Unsecured Promissory Note Template |

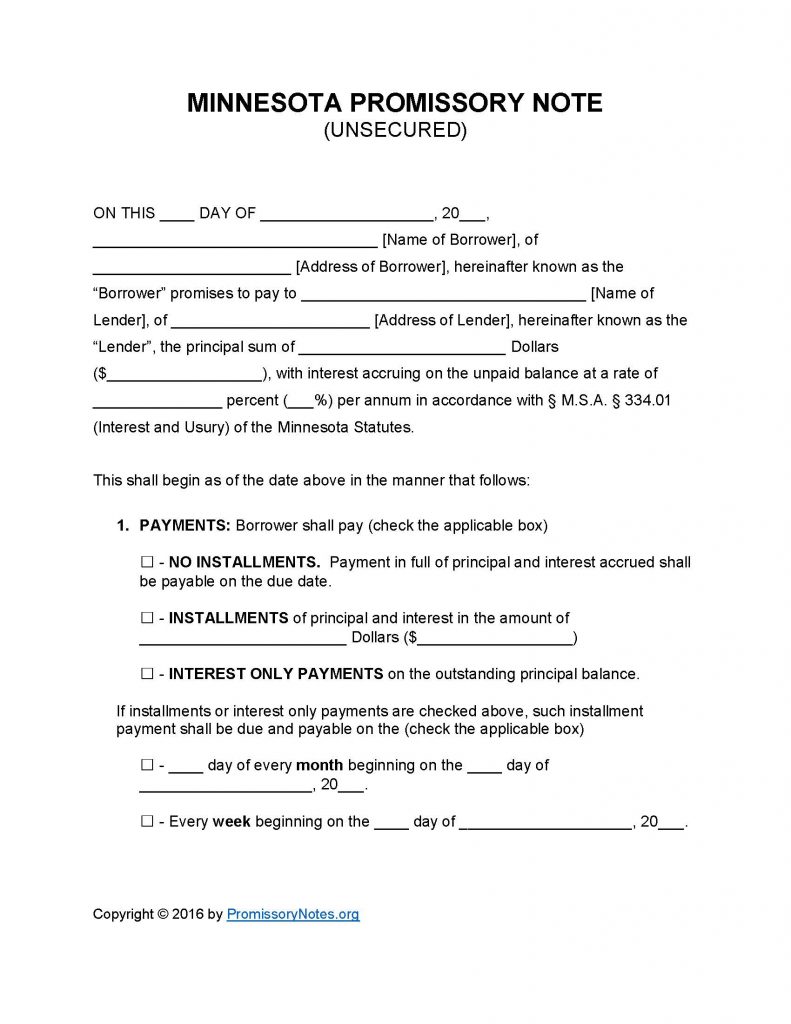

Use the links near the top of the page to download the Minnesota Unsecured Promissory Note Template. The template is designed to be used when drafting an unsecured promissory note (for use in the State of Minnesota). Unsecured notes, in contrast to secured ones, do not require that the borrower pledge collateral (in order to receive the loan from the lender).

Minnesota Usury Law: According to §334.01 the maximum interest rate that can be charged is six percent (6%) per annum.

How to Write

Step 1 – Download the template.

Step 2 – The first page of the document must contain the following (enter into the first paragraph):

- Date

- Name of borrower

- Address of borrower

- Name/address of lender

- AND

- Provide the principal sum

- Submit the interest rate percentage

Step 3 – Payments – Provide the payment method by checking the box that corresponds to the agreed upon method:

- No Installments

- Installments

- Interest Only

Step 4 – If required:

- Provide the installment amount borrower has agreed to pay.

- Submit the monthly/weekly installment schedule.

Step 5 – Due Date:

- Provide the date in the applicable format (dd/m/yy).

Step 6 – Interest Due in Event of Default:

- Submit the interest rate that the lender will apply to the borrower’s account if they default on the loan.

Step 7 – Late Fees:

- Provide the agreed upon late fee amount/grace period (how long the borrower has to make a past-due payment).

Step 8 – Acceleration:

- Submit the period of time that the borrower will have to cure a default on the loan.

Step 9 – Signatures:

- Submit the date (of signing).

- Provide the names of the borrower, lender, and witnesses.

- The borrower, lender, and witnesses MUST sign the form in the appropriate sections.

Minnesota Unsecured Promissory Note – Adobe PDF – Microsoft Word