|

Mississippi Unsecured Promissory Note Template |

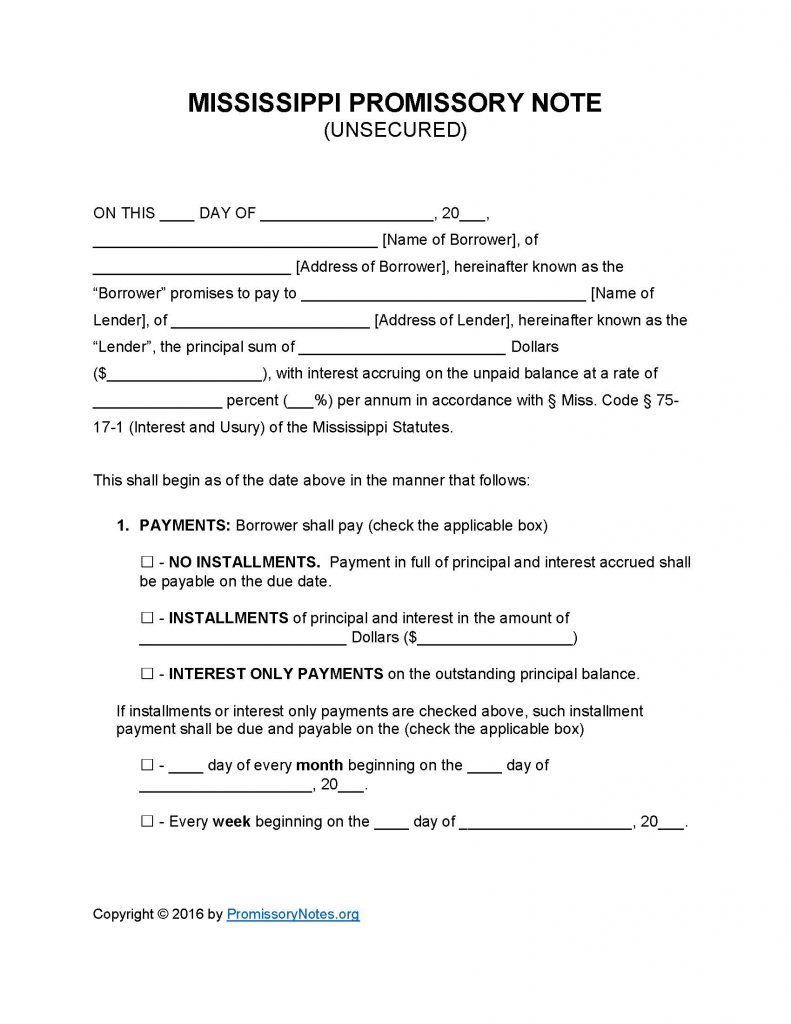

The Mississippi Unsecured Promissory Note Template is a legal form that can be downloaded as a .PDF or Word file. The form is used to outline the terms of a loan (e.g. principal sum, payment method, interest rates, etc.). As opposed to secured notes, unsecured notes are not backed by a borrower’s collateral. Therefore, unsecured notes/loans are usually only provided to borrowers who are deemed “low risk,” or are otherwise not at risk of defaulting on the loan.

How to Write

Step 1 – Use the links near the top of the page to download the form.

Step 2 – The opening paragraph of the note is required to have the following information:

- Date of agreement

- Name of borrower

- Name of lender

- Address of borrower

- Address of lender

- Principal sum

- Interest rate

Step 3 – Payments:

- Select the borrower’s payment method (“No Installments” OR “Installments” OR “Interest Only”).

- If the borrower’s payment method is either “Installments” or “Interest Only” then the installment schedule must be provided (in monthly OR weekly format).

Step 4 – Due Date:

- Fill in the due date details.

Step 5 – Interest Due in Event of Default:

- Provide the agreed upon interest rate that shall be applied to the balance IF the borrower defaults on the note/loan.

Step 6 – Late Fees:

- Submit how long the borrower will have after missing a payment before they may be charged with a late fee.

- Fill in the late fee charge.

Step 7 – Acceleration:

- Provide how long the borrower will have after defaulting on the loan to “cure” the default.

Step 8 – Signatures:

- Fill in the date of signing.

- Provide the printed names of the borrower, lender, and witnesses.

- The borrower MUST sign the form in the allotted input field.

- AND

- The lender/witnesses must sign their names in the appropriate sections.

Mississippi Unsecured Promissory Note – Adobe PDF – Microsoft Word