|

Montana Secured Promissory Note Template |

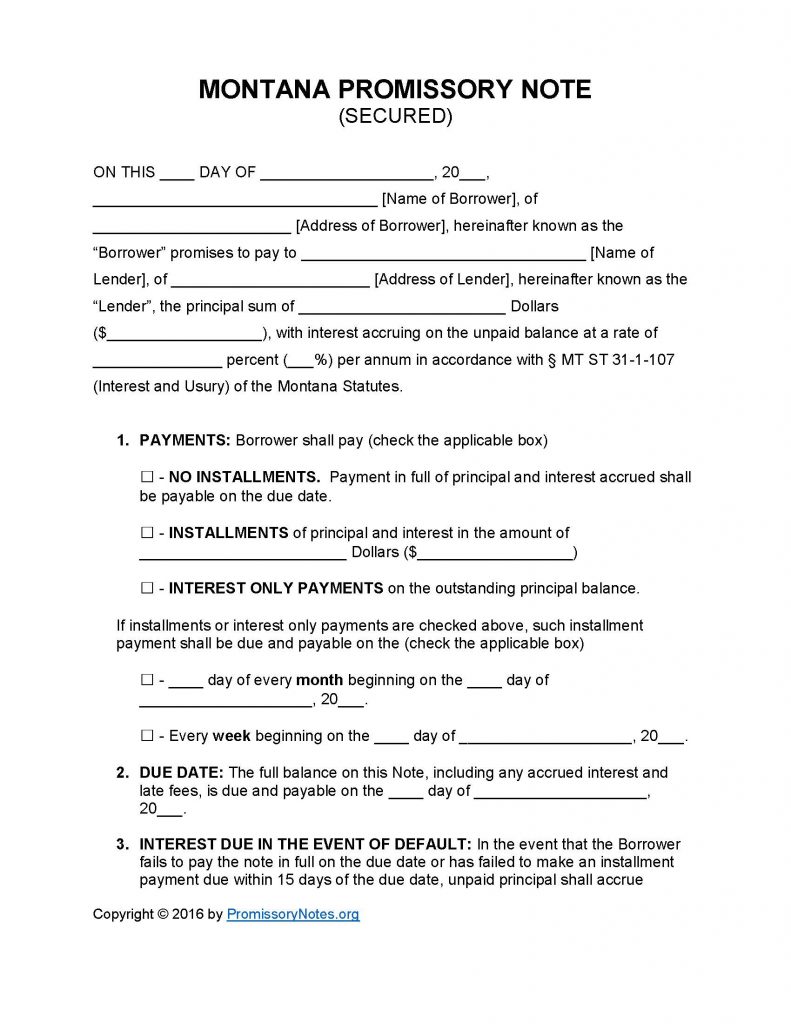

The Montana Secured Promissory Note Template is an interest-bearing legal form that is used to outline the term length, interest rate, principal sum, and other terms of a loan. The document is entered into by a lender and borrower. Unlike secured notes, secured notes are not backed by a borrower’s pledged assets (i.e. collateral). Use the instructions below to learn the requirements of a promissory note.

How to Write

Step 1 – Download the template.

Step 2 – Enter the following into the opening paragraph:

- Date

- Name and address of borrower

- Name and address of lender

- AND

- Provide the agreed upon principal sum/interest rate

Step 3 – Payments – Provide the following information:

- Payment method (check the box of the corresponding method)

- Installment amount (if required)

- Monthly/weekly schedule (if applicable)

Step 4 – Due Date: Enter the note’s due date.

Step 5 – Interest Due in Event of Default:

- Submit the interest percentage that will be applied to the note IF the borrower defaults on it.

Step 6 – Late Fees:

- Fill in how long the borrower will have to make a past-due payment (before they will be charged a late fee).

- Submit the amount that will be charged in the event of a missed/late payment.

Step 7 – Acceleration:

- Enter the number of days the borrower will have after defaulting on the note to “cure” the default.

Step 8 – Security:

- Fill in the borrower’s collateral.

Step 9 – Signatures:

- Submit the date (of signing)

- Name of borrower

- Signature of borrower

- Name of lender

- Lender’s signature

- Names and signatures of witnesses

Montana Secured Promissory Note – Adobe PDF – Microsoft Word