|

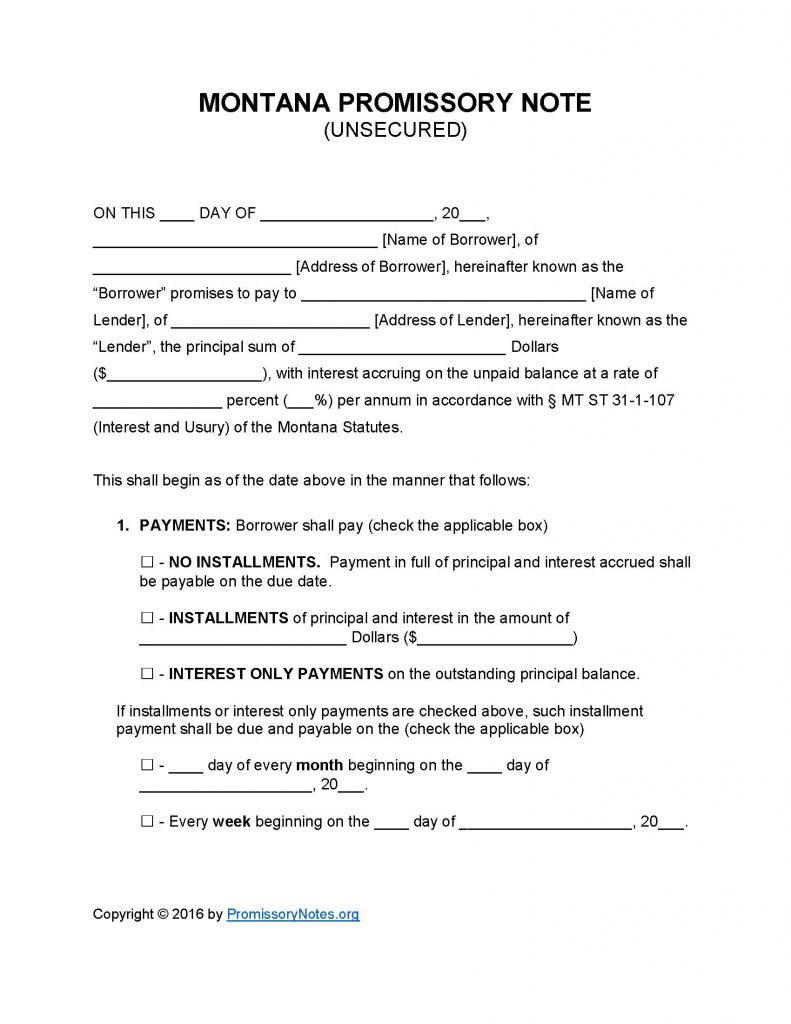

Montana Unsecured Promissory Note Template |

Download the Montana Unsecured Promissory Note Template in .PDF or Word format. The template is intended to be used as a starting point when drafting an unsecured note (for use in the State of Montana). It should be noted that unsecured notes differ from secured notes, because they do not have the backing of the borrower’s collateral.

- Usury Details: The State of Montana has a default interest rate of 10%. Interest rates that are agreed to in writing can be any number up to 15% (or anywhere below 6% of the Federal Reserve’s prime rate). Additional information regarding Montana usury law can be found here.

How to Write

Step 1 – Download the form.

Step 2 – Submit the following:

- Date of note

- Name/address of borrower

- Name/address of lender

- Principal sum

- Interest rate (per annum)

Step 3 – Payments:

- The payments subsection details the payment amount, frequency, etc.

- Select the payment method.

- Provide the installment frequency (monthly/weekly) AND the installment amount (if required).

Step 4 – Due Date:

- Fill in the date in which the principal sum is due by.

Step 5 – Interest Due in Event of Default:

- Submit what the interest rate will be adjusted to should the borrower default on the loan.

Step 6 – Late Fees:

- This subsection details the amount of time the lender will provide the borrower to make a past-due payment before a late charge is applied to the balance.

- Enter the charge that will be applied IF the borrower misses the cutoff period.

Step 7 – Acceleration:

- Provide the number of days the lender will give the borrower to cure a default before taking further action.

Step 8 – Signatures:

- Fill in the date.

- Provide the names of the borrower, lender, and witnesses.

- AND

- ALL parties must sign the document in the appropriate input sections.

Montana Unsecured Promissory Note – Adobe PDF – Microsoft Word