|

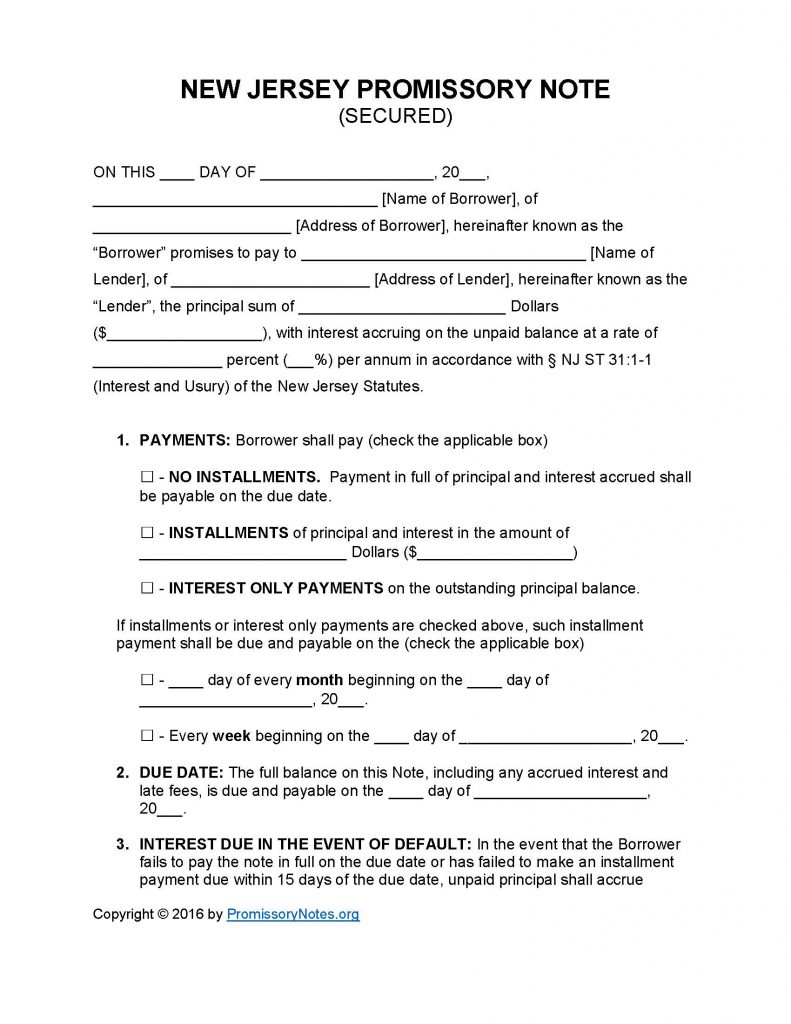

New Jersey Secured Promissory Note Template |

Use the New Jersey Secured Promissory Note Template to create a free note (designed for use in the State of New Jersey). Promissory notes are used to detail various aspects of a loan (e.g. amount, interest percentage, payment method, etc.). The instructional guide posted below may be used as a reference when drafting your note.

Note: Secured notes require the borrower to pledge collateral (i.e. security).

How to Write

Step 1 – Download the template.

Note: The .PDF template can be completed electronically.

Step 2 – The note’s opening paragraph is required to have the following information:

- Date of agreement

- Full name of lender (printed)

- Address of lender

- Printed name of borrower

- Address of borrower

- AND

- The agreed upon principal sum/interest rate must be submitted

Step 3 – Payments – The borrower may select one of three payment methods:

- No Installments

- Installments – Provide the amount the borrower has agreed to pay as an installment.

- Interest Only

Step 4 – If the chosen method is “Installments” OR “Interest Only,” the following details must be submitted:

- Monthly payment schedule

- OR

- Weekly payment schedule

Step 5 – Due Date – Provide the date in which the full balance of the note (in addition to interest/fees/etc.) will be due by.

Step 6 – Interest Due in Event of Default:

- Should the borrower go into default, they must pay the interest percentage submitted in this subsection.

Step 7 – Late Fees:

- Fill in the period of time the borrower will have to make a past-due payment. Should the borrower fail to make the payment within the number of days submitted in this subsection, they will be charged a late fee.

- Submit the amount that will be charged as a late fee.

Step 8 – Acceleration:

- In the event of a default, the lender shall provide the borrower a specific period of time to “cure” the default before they take further action.

- Enter how long the borrower will have to bring the account current.

Step 9 – Security:

- Fill in a description of the secured asset(s).

Step 10 – Signatures:

- The last subsection of the document is where the parties must submit their signatures.

- Enter the names of the borrower, lender, and witnesses.

- Fill in the date.

- AND

- Borrower must submit a signature.

- Lender must provide a signatures.

- Witnesses are REQUIRED to sign the document.

New Jersey Secured Promissory Note – Adobe PDF – Microsoft Word