|

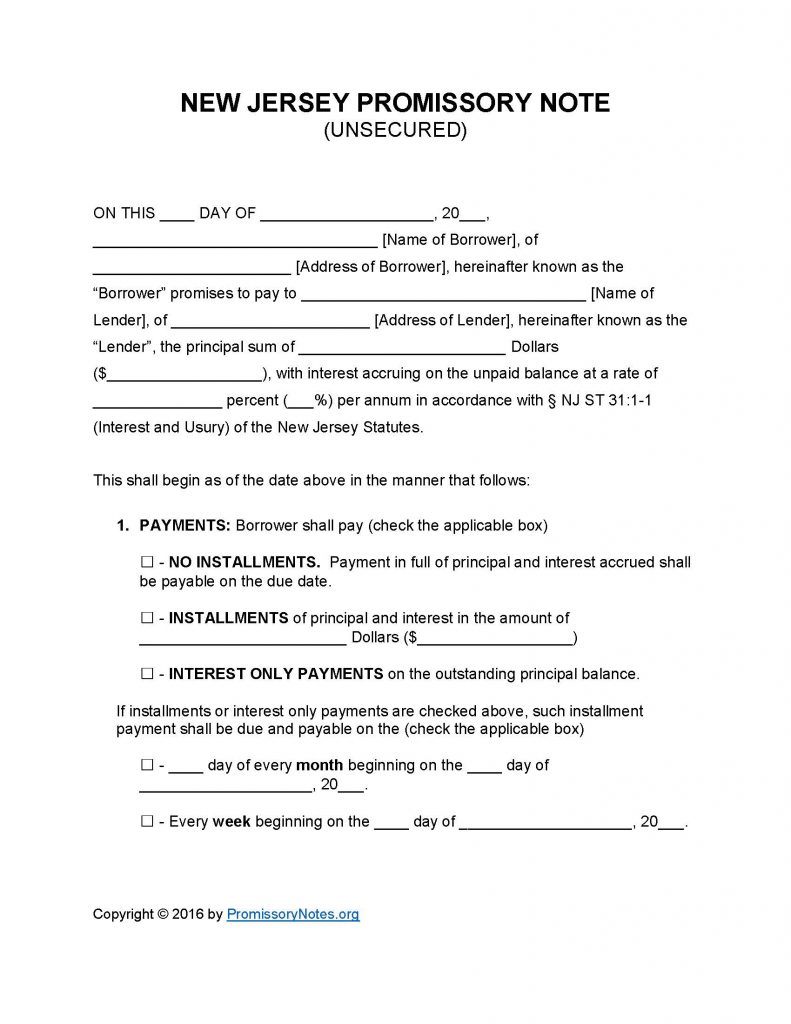

New Jersey Unsecured Promissory Note Template |

The New Jersey Unsecured Promissory Note Template is a legal document, that as the name suggests does not require the borrower to provide collateral in exchange for a loan (unlike a secured note). The main advantage of a promissory note is the fact that it is legally enforceable. If the borrower does not follow the terms of the note, the lender can file a civil suit against them.

Note: Unsecured notes are typically drafted with high interest rates (relative to secured notes).

How to Write

Step 1 – The .PDF or Word template can be downloaded via the links posted on this page.

Step 2 – Submit the following:

- Date of note

- Name of borrower

- Address of borrower

- Lender’s name and address

- Loan amount (i.e. principal sum)

- Interest percentage

Step 3 – Payments – The borrower must agree to one of the three following forms of repayment:

- No Installments

- Installments

- Interest Only

Step 4 – The monthly/weekly due date information must be submitted if the borrower’s form of repayment is “Installments” OR “Interest Only.”

Step 5 – Due Date – Supply the date that the borrower must have the full sum of the note paid (in full) by.

Step 6 – Interest Due in Event of Default:

- If the borrower defaults on the note, they will need to pay the interest percentage submitted in this subsection.

Step 7 – Late Fees:

- Provide the exact number of days the borrower will have to make a payment after they have missed the agreed upon due date.

- Enter the amount the borrower will be charged (as a late fee) if they do not make a payment on time.

Step 8 – Acceleration:

- In the event of a default on the note, the borrower must cure the default within the number of days specified in this subsection.

Step 9 – Signatures:

- Fill in the date.

- Submit the borrower’s name (printed).

- Borrower MUST sign the form.

- Submit the lender’s name.

- Lender is REQUIRED to sign the form.

- AND

- Witnesses must print/sign their names.

New Jersey Unsecured Promissory Note – Adobe PDF – Microsoft Word