|

New York Unsecured Promissory Note Template |

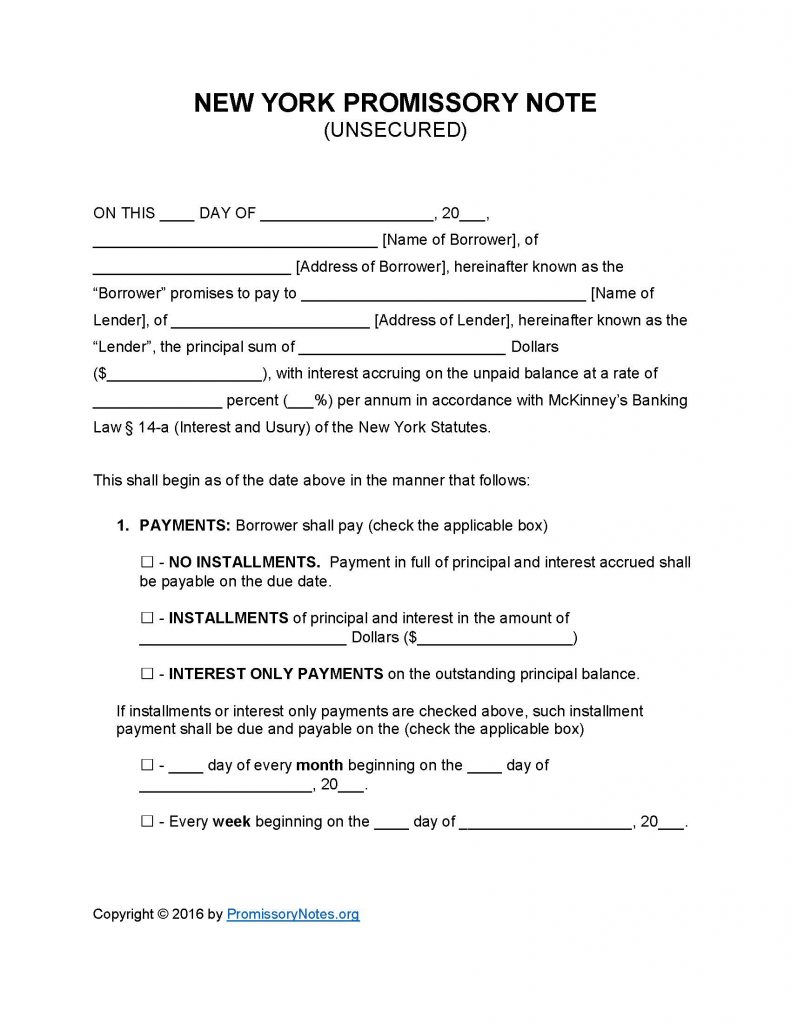

The New York Unsecured Promissory Note Template is a contractual document, entered into by a lender and borrower, which establishes the structure of a loan agreement. The interest rate, principal sum, payment amount, payment schedule, and other various terms are detailed in the note. The note also covers what will happen if the borrower fails to make payments towards the loan.

How to Write

Step 1 – Download the document.

- Note: The form is available in .PDF OR Word format.

Step 2 – Provide the following:

- Date

- Name/address of borrower

- Name/address of lender

- Amount of loan

- Interest percentage (per annum)

Step 3 – Payments – Select one of the three available payment options:

- No Installments

- Installments

- Interest Only

Step 4 – If applicable:

- Provide the installment amount

- Submit the payment schedule (monthly/weekly)

Step 5 – Due Date:

- Fill in the date in which the note must be repaid in full by.

Step 6 – Interest Due in Event of Default:

- Enter what interest rate the borrower will be charged if they default on the note.

Step 7 – Late Fees:

- Enter how long the borrower will have after missing a scheduled payment date to make the past-due payment.

- Submit how much the borrower will be charged if they miss a payment.

Step 8 – Acceleration:

- Provide how long the borrower will have to cure a default on the loan.

Step 9 – Signatures:

- This subsection must contain the date, names of all of the involved parties, and the signatures of the lender, borrower, and witnesses.

New York Unsecured Promissory Note – Adobe PDF – Microsoft Word