|

Ohio Unsecured Promissory Note Template |

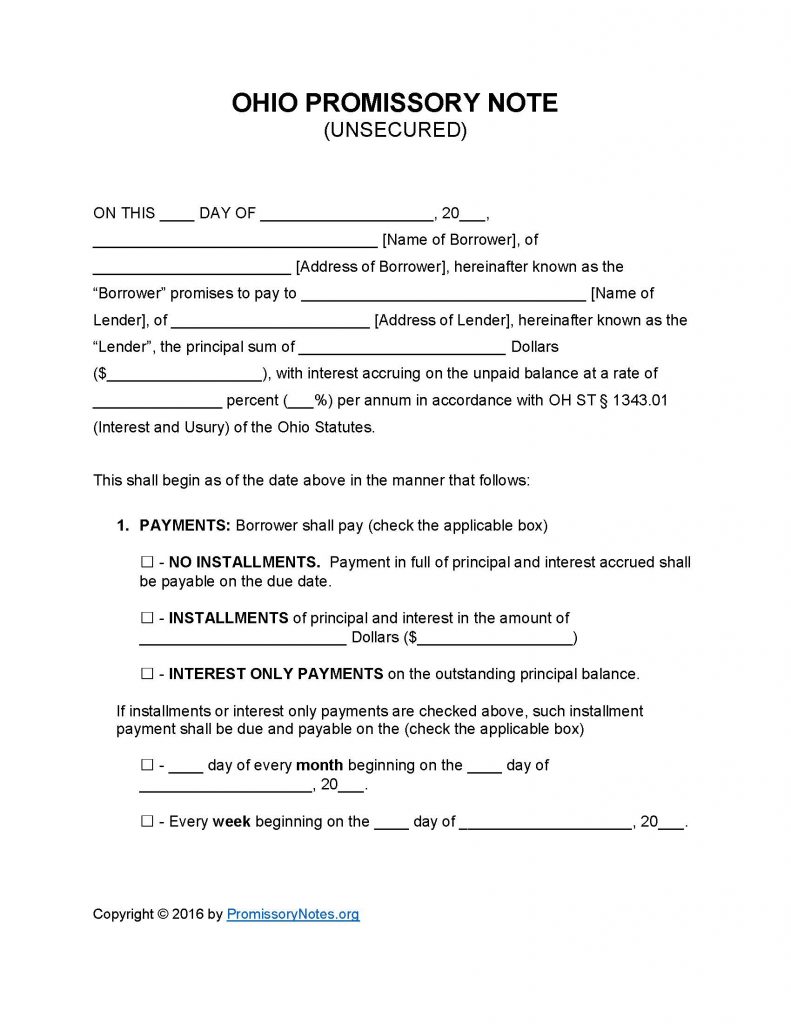

The Ohio Unsecured Promissory Note Template provides a written record of an agreement between two parties (a lender/borrower) regarding a loan. The template can only be used to draft an unsecured promissory note (i.e. a note that does not require collateral from the borrower). Unsecured notes typically feature higher interest rates, due to the fact that there is no attached security (in the form of collateral). The instructions posted below can be used as a reference when filling out the template.

How to Write

Step 1 – Download the template.

Step 2 – Fill in the following details (within the template’s opening paragraph):

- Date

- Names of borrower/lender

- Addresses of borrower/lender

- Amount of loan

- Interest rating

Step 3 – Payments – The borrower can agree to pay back the loan via one of the following methods:

- No Installments

- Installments – (the installment amount must be provided)

- Interest Only

Step 4 – If the repayment method is “Installments” or “Interest Only,” the monthly OR weekly due dates must be submitted.

Step 5 – Due Date:

- The final date in which the borrower has to repay the full balance of the loan.

Step 6 – Interest Due in Event of Default:

- The amount of interest the borrower will be charged should they default on the note.

Step 7 – Late Fees:

- Provide how long the borrower will have to make a past-due payment before a late charge will be applied to the owed balance.

- Submit the amount the borrower will be charged.

Step 8 – Acceleration:

- Enter the exact number of days the borrower will have to cure a default on the loan.

Step 9 – Signatures:

- The date must be filled in using the appropriate format.

- Enter the borrower’s name.

- Enter the lender’s name.

- Submit the names of the witnesses.

- AND

- ALL parties are required to sign the document.

Ohio Unsecured Promissory Note – Adobe PDF – Microsoft Word