|

North Carolina Unsecured Promissory Note Template |

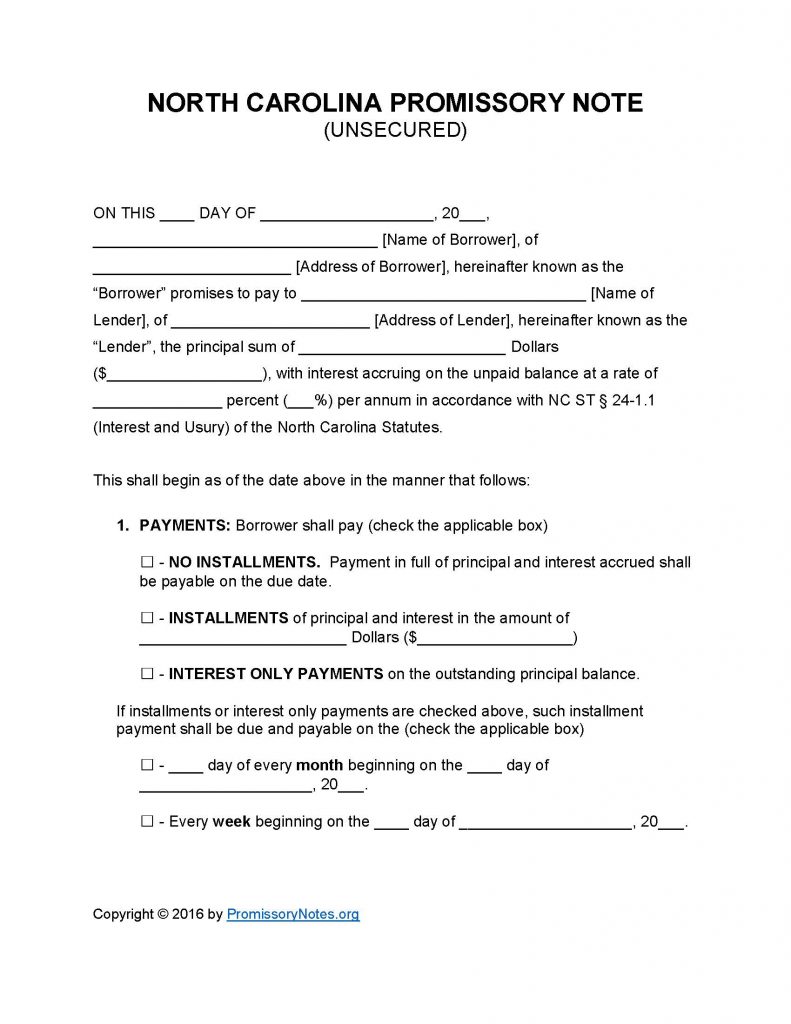

The North Carolina Unsecured Promissory Note Template is a legal form that establishes the various terms of a loan agreement. The document, entered into by a lender and borrower, is legally enforceable once it has been signed the involved parties. Unsecured promissory notes are not guaranteed by the backing of a borrower’s pledged assets (i.e. collateral). This is the primary difference between unsecured and secured notes. The instructions provided below can be used as a reference when drafting your unsecured promissory note.

How to Write

Step 1 – Download the form.

Note: The .PDF file can be filled out electronically.

Step 2 – Provide the following details on the first page of the form (within the first paragraph):

- Date of agreement

- Names of borrower/lender

- Addresses of borrower/lender

- AND

- Amount that is to be loaned

- Interest rate that the borrower will be charged

Step 3 – Payments – Select the borrower’s method of repayment by checking the corresponding box off (from the following options):

- No Installments

- Installments

- Interest Only

Step 4 – If the borrower’s payment method is “Installments” or “Interest Only,” the monthly OR weekly payment schedule must be provided in the appropriate input fields.

Step 5 – Due Date:

- Fill in the principal sum’s final due date. The full balance of the loan (including interest/fees) must be paid in full by this date.

Step 6 – Interest Due in Event of Default:

- Provide the interest rate that will be charged to the borrower (should they default on the loan).

Step 7 – Late Fees:

- Fill in the number of days in which the borrower will have after missing a scheduled payment (before the lender can charge a late fee).

- Submit the late fee amount.

Step 8 – Acceleration:

- Enter how long the borrower will have, after defaulting on the note, to “cure” the default.

Step 9 – Signatures:

- In order for the form to be enforceable in court, it must be signed by the borrower, lender, and witnesses.

- The printed names of each party must also be provided.

- AND

- The date of signing must be submitted.

North Carolina Unsecured Promissory Note – Adobe PDF – Microsoft Word