|

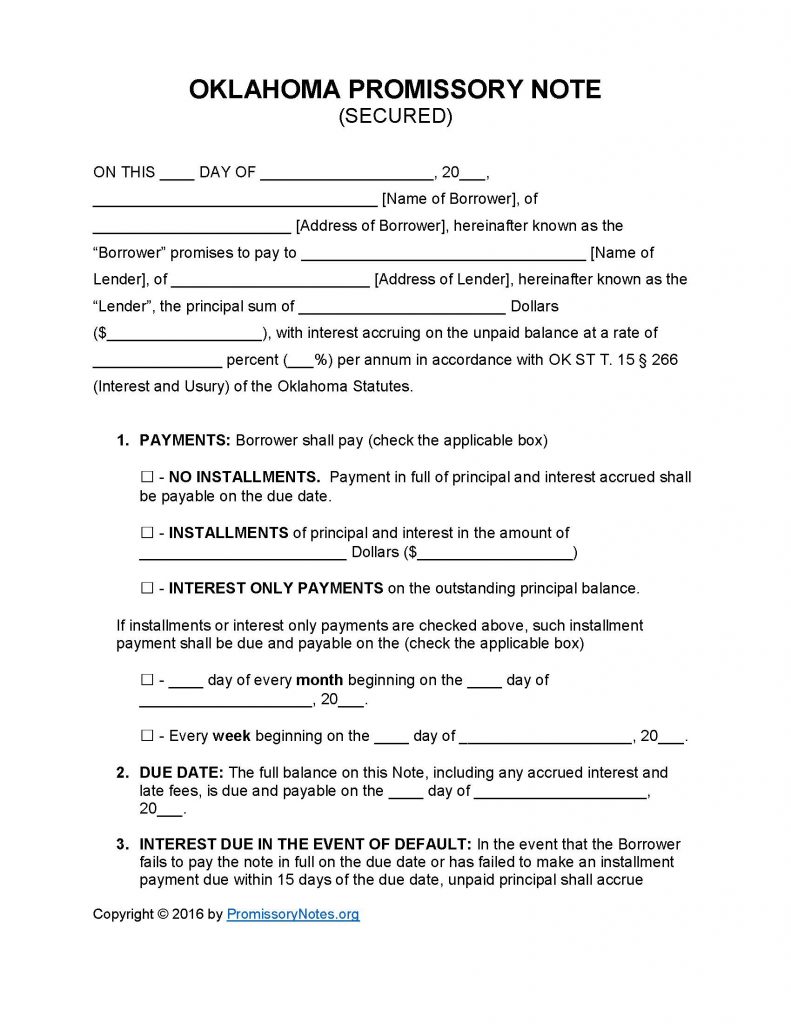

Oklahoma Secured Promissory Note Template |

The Oklahoma Secured Promissory Note Template is to be used to detail the repayment options, principal amount, interest rate, and other facets of a loan agreement. The template is a contractual document, entered into by two parties (a lender/borrower), that is legally enforceable (provided that it’s been formatted properly). Use the links provided on this page to download the document in your format of choice.

Note: The document MUST be signed by the borrower/lender in order to be enforceable in court.

How to Write

Step 1 – Download the document.

Step 2 – The opening paragraph is required to have the following information:

- Date

- Names of borrower and lender

- Addresses of borrower/lender

- Amount that is to be loaned to the borrower

- Interest rate that borrower has agreed to pay

Step 3 – Payments:

- No Installments

- Installments

- Interest Only

Step 4 – Payments (continued):

- Enter the installment amount if the selected method is “Installments.”

- Provide the monthly/weekly frequency if applicable.

Step 5 – Due Date:

- Submit the due date in the given format (dd/m/yy).

- Upon signing the document, the borrower is obligated to repay the loaned amount by this date.

Step 6 – Interest Due in Event of Default:

- Fill in what interest percentage the borrower will be required to pay if they default on the loan.

Step 7 – Late Fees:

- If the borrower does not make a payment in accordance with the agreed upon schedule, they will be required to pay a late fee.

- Submit the late fee amount, and the period of time (after the initial due date) that the borrower will have to make a payment.

Step 8 – Acceleration:

Enter the period of time that the borrower will have, after defaulting on the loan, to “cure” the default. If the borrower does not cure the default within this time frame, the lender can take legal action.

Step 9 – Security:

- Submit the borrower’s collateral.

Step 10 – Signatures:

- Fill in the date.

- Provide the printed name of the borrower.

- Enter the names of the lender and witnesses.

- The borrower, lender, and witnesses must sign the document.

Oklahoma Secured Promissory Note – Adobe PDF – Microsoft Word