|

Oregon Unsecured Promissory Note Template |

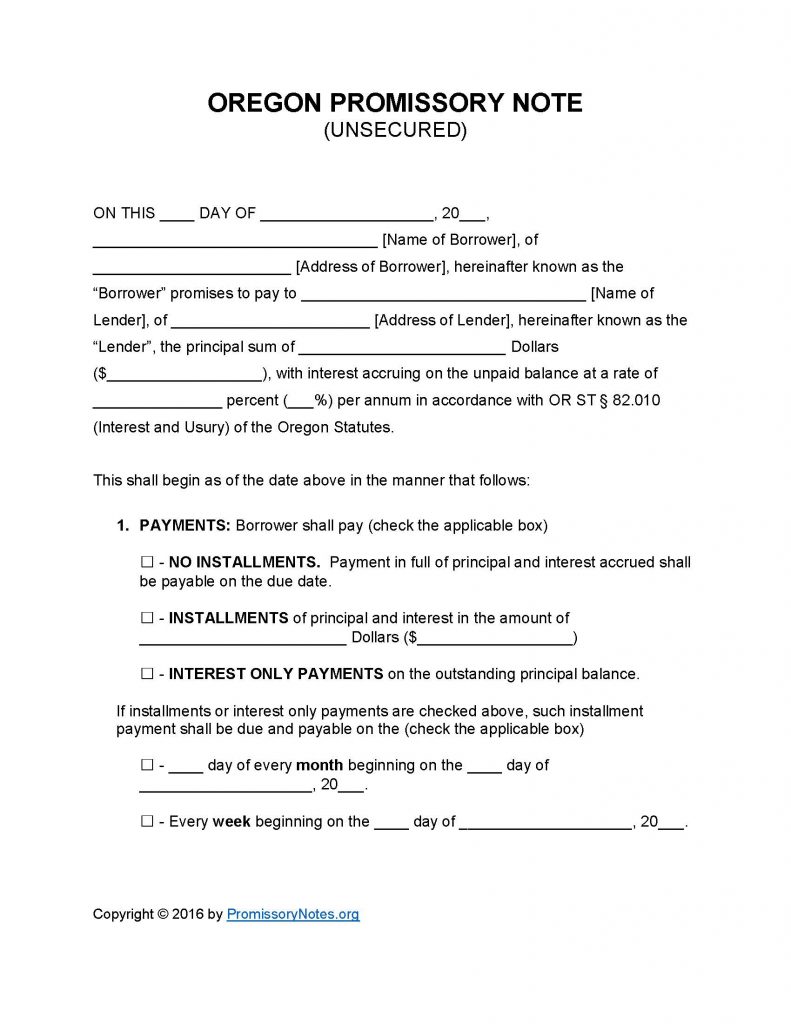

The Oregon Unsecured Promissory Note Template is a contractual form that is to be used when creating an unsecured promissory note. The document can be downloaded as .PDF or MS Word file. The note outlines the specific terms of a loan including the loaned amount, interest rate, borrower’s method of repayment, payment schedule, etc. Use the guide posted below as a reference when drafting your promissory note.

How to Write

Step 1 – Download the template.

Step 2 – Provide the following details:

- Date of note

- Name of borrower

- Address of borrower

- Name/address of lender

- Principal sum

- Interest rate

Step 3 – Payments – Select the agreed upon payment method:

- No Installments

- Installments

- Interest Only

Note: If the borrower’s method of repayment is “Installments” or “Interest Only,” the payment schedule (monthly/weekly) must be provided.

Step 4 – Due Date:

- Provide the due date (of the note’s principal sum).

Step 5 – Interest Due in Event of Default:

- This subsection must contain the interest rate that the borrower will be charged if they default on the loan.

Step 6 – Late Fees:

- Fill in the precise number of days the borrower will have to make a payment (after missing a scheduled payment date).

- Submit the late fee that will be charged if the borrower does not make a payment within the specified number of days.

Step 7 – Acceleration:

- If the borrower defaults on the note, they must “cure” the default within the number of days specified in this subsection.

Step 8 – Signatures – The last subsection of the form must contain the following:

- Date

- Name/signature of borrower

- Name/signature of lender

- Names/signatures of witnesses

Oregon Unsecured Promissory Note – Adobe PDF – Microsoft Word