|

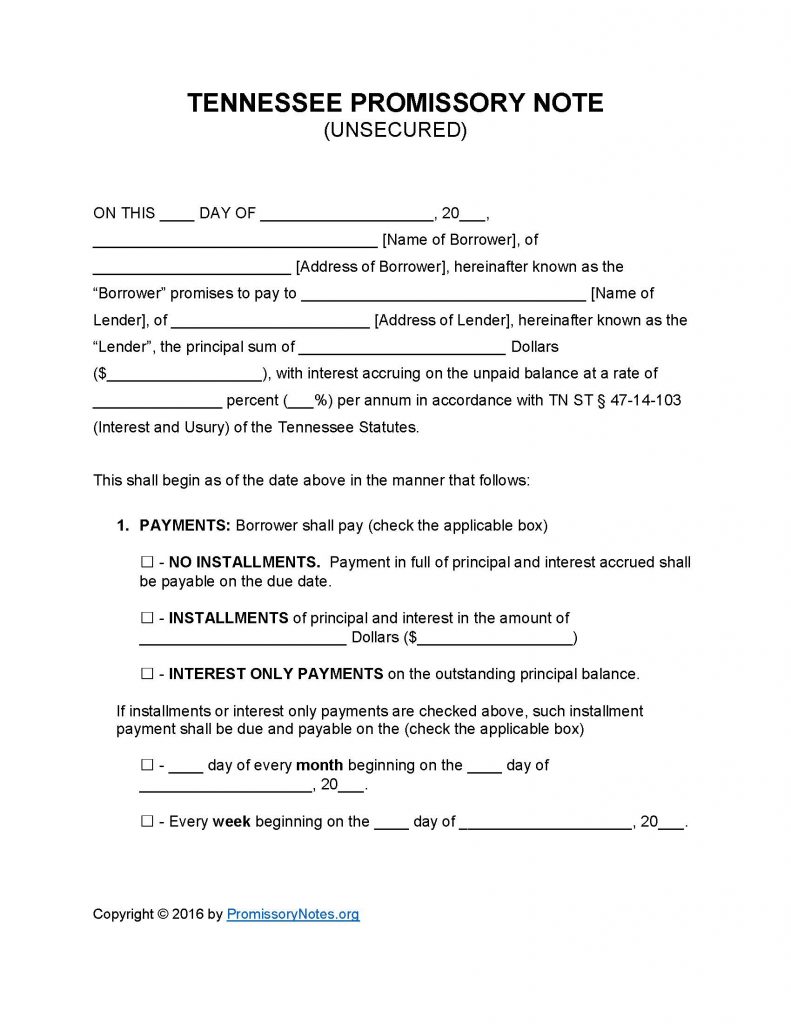

Tennessee Unsecured Promissory Note Template |

The Tennessee Unsecured Promissory Note Template is available for download on this page (in .PDF or Word format). Unsecured promissory notes are a type of legal form which describe the various features of a loan agreement. Contrary to secured notes, unsecured notes do not have security (i.e. collateral) pledged from the borrower. Use the instructions in the guide below to learn the requirements of a properly drafted promissory note.

How to Write

Step 1 – The first step is to download the template.

Step 2 – Open the document (or print it out) and supply the following details:

- Date (dd/m/yy format).

- Names of borrower and lender.

- Addresses of borrower and lender.

- AND

- Fill in the principal sum as well as the interest rate.

Step 3 – Payments – This subsection details the agreed upon payment method, amount, and schedule.

- Provide the payment method (check the appropriate box).

- Enter the installment amount if required, and then submit the monthly OR weekly payment schedule.

Step 4 – Due Date:

- Fill in the final due date of the note’s principal sum.

Step 5 – Interest Due in Event of Default:

- Submit the interest rate that will be applied to the balance of the loan in the event of a default.

Step 6 – Late Fees:

- Enter the late fee amount.

- AND

- Provide how long the borrower will have to make a past-due payment (before the late fee is applied to the balance that is due).

Step 7 – Acceleration – This subsection details the period of time that the borrower will have, after defaulting, to “cure” the default (before the lender can take legal action).

Step 8 – Signatures:

- Provide the date in the given format.

- Enter the name of the borrower.

- Borrower must sign the form.

- Enter the name of the lender.

- Lender must sign their name.

- Witnesses must print AND sign their names.

Tennessee Unsecured Promissory Note – Adobe PDF – Microsoft Word