|

Washington Unsecured Promissory Note Template |

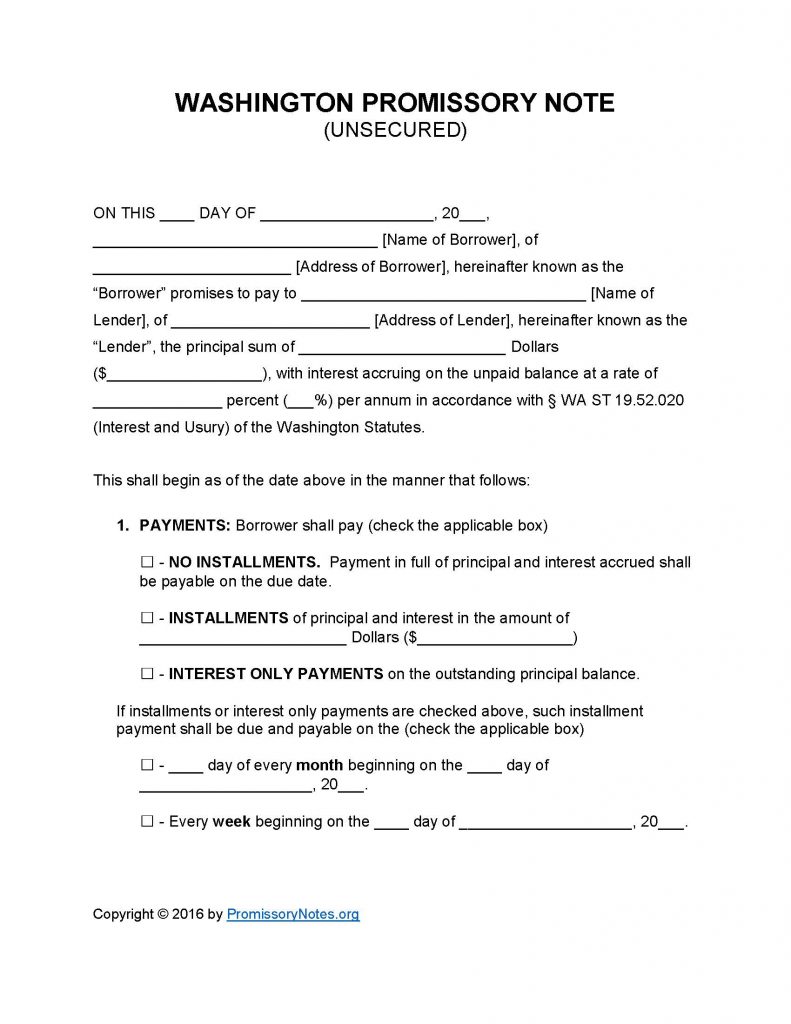

The Washington Unsecured Promissory Note Template can be downloaded in .PDF or Word format. The template should only be used to create an unsecured note, not a secured one. The reason for this is that unsecured notes do not need the backing of collateral (whereas secured notes do have the need). The template can be filled out in a matter of minutes, and if the .PDF file is used it can even be filled out digitally.

How to Write

Step 1 – Download the form.

Step 2 – Fill in the opening paragraph with the following:

- Date of agreement

- Names of borrower and lender

- Addresses of borrower and lender

- AND

- Enter the amount of the loan/interest rate

Step 3 – Payments – Submit the payment method of the borrower:

- No Installments

- OR

- Installments – enter the installment amount AND select the payment frequency.

- OR

- Interest Only – submit the payment schedule.

Step 4 – Due Date:

- Submit the principal sum’s due date (the full balance of the note must be paid off by this date).

Step 5 – Interest Due in Event of Default:

- Fill in the interest rating that will be charged to the borrower in the event of a default.

Step 6 – Late Fees:

- This subsection details how long the borrower will have to make a past-due payment. If the borrower does not make the payment within the specified time period, they will be charged the submitted late fee.

Step 7 – Acceleration:

- Enter the period of time that will be provided to the borrower to cure a default on the loan (before the lender will take further action).

Step 8 – Signatures:

- Submit the date in dd/m/yy format.

- Enter the names of the parties (borrower/lender/witnesses).

- The parties must sign the document.

Washington Unsecured Promissory Note – Adobe PDF – Microsoft Word