|

West Virginia Secured Promissory Note Template |

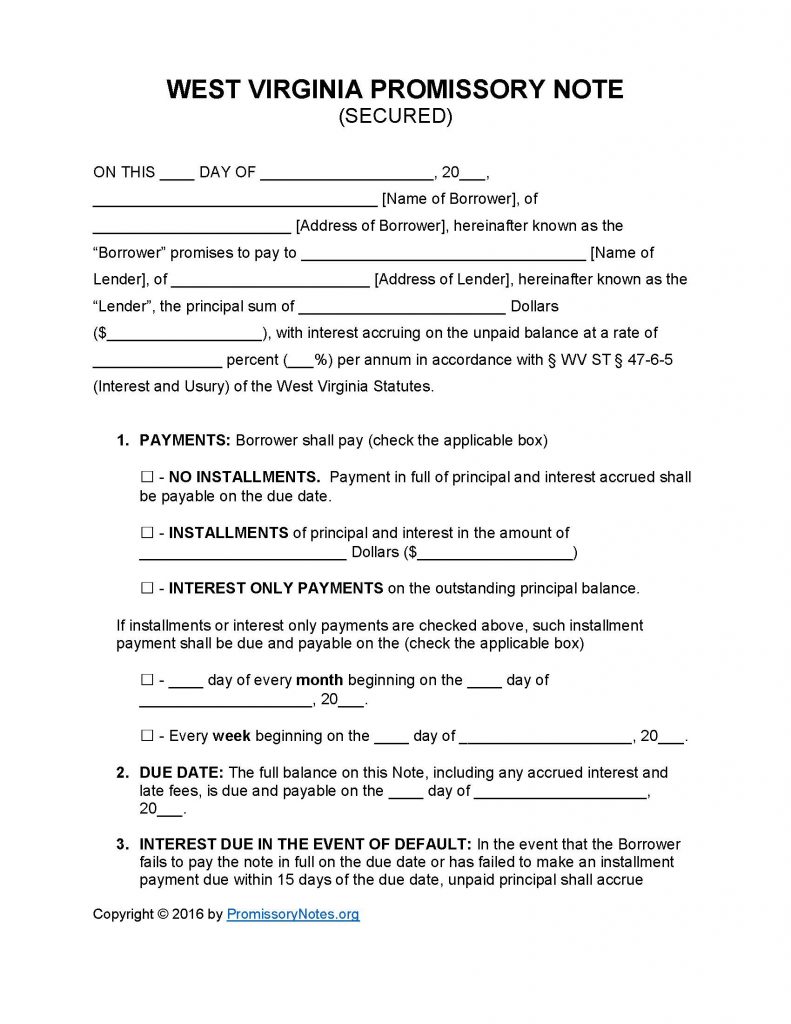

The West Virginia Secured Promissory Note Template is a contractual document used to establish a legally enforceable loan agreement. The principal sum, interest rate, payment frequency, and other terms are all contained within the document.

- Note: Only use the secured template if you’re entering into an agreement where the borrower will be providing some form of collateral.

How to Write

Step 1 – Download the document.

- Note: The .PDF template can be digitally filled out/signed.

Step 2 – Fill in the following information:

- Date

- Name/address of borrower

- Name/address of lender

- Amount that will be loaned to borrower

- Interest that borrower will be charged

Step 3 – Fill in the required payment information:

- Payment method (“No Installments” OR “Installments” OR “Interest Only”)

- Installment amount

- Frequency of payments

Step 4 – Due Date:

- Submit what date the borrower will have until, to pay the full principal sum of the note back to the lender.

Step 5 – Interest Due in Event of Default:

- Enter what interest rating will be applied to the balance, should the borrower end up defaulting on the loan.

Step 6 – Late Fees:

- Fill in how long the borrower will have, after missing a payment, to pay the past-due amount.

- Enter how much the borrower will be charged if they fail to make a payment.

Step 7 – Acceleration:

- If the borrower defaults on the loan, they will need to cure the default within the period of time submitted in this section.

Step 8 – Security:

- Submit a description of what the borrower has pledged as collateral.

Step 9 – Signatures:

- Enter the date and the names of each party.

- ALL parties MUST sign the note in order for it to be valid.

West Virginia Secured Promissory Note – Adobe PDF – Microsoft Word