|

Wyoming Secured Promissory Note Template |

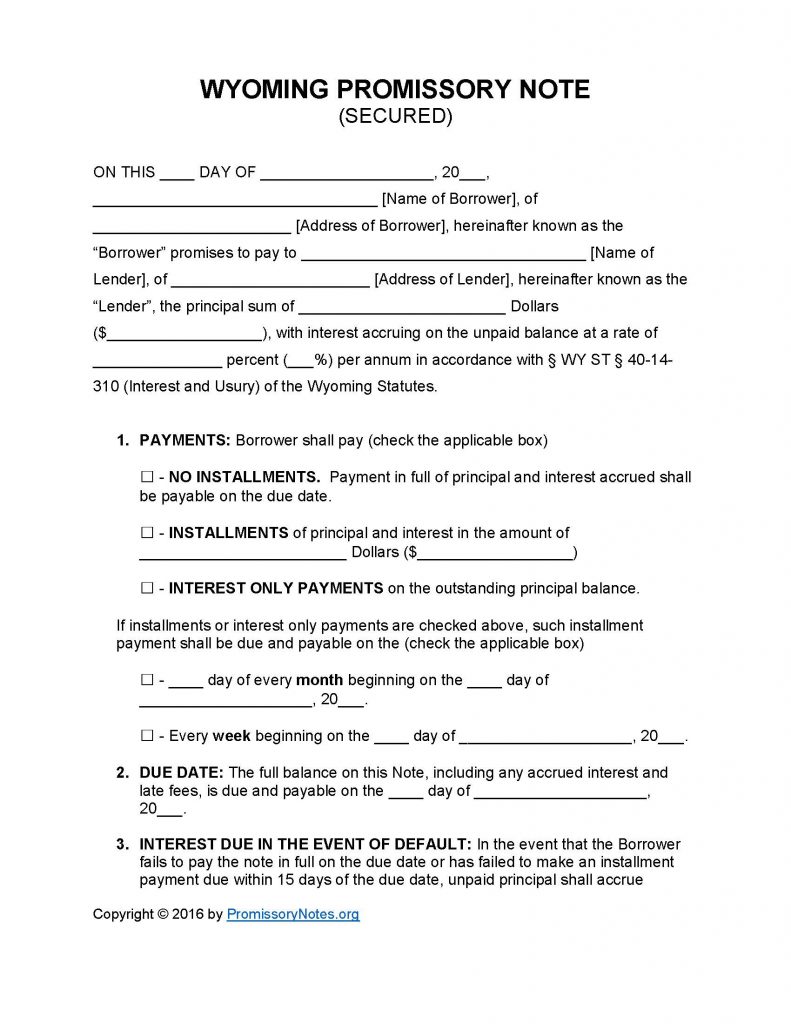

The Wyoming Secured Promissory Note Template is a legal form used to provide an outline of a loan’s various terms. The template can be downloaded in two separate formats (.PDF or Word). This template should only be used if you are drafting a secured note (i.e. a note in which the borrower will be pledging collateral). Use the instructional guide posted below as a reference when drafting your note.

How to Write

Step 1 – Download the template via the links near the top of the page.

Step 2 – Submit the following details:

- Date of note

- Names of borrower/lender

- Addresses of borrower/lender

- Amount of note

- Agreed upon interest rate

Step 3 – Payment Information:

- Select the appropriate payment method.

- Provide the installment amount/schedule if applicable.

Step 4 – Submit the principal sum’s due date information.

Step 5 – Interest in Event of Default:

- Enter the interest rate that will be applied to the note if it goes into default.

Step 6 – Late Fees:

- Fill in the period of time that the borrower will be given to bring the account current after missing a payment.

- Enter the late fee that will be applied to the account if the borrower fails to make a payment within the specified time limit.

Step 7 – Acceleration:

- If the borrower defaults on the note and fails to cure it within the time period specified in this subsection, the lender can declare the full sum of the note due immediately.

Step 8 – Security:

- Submit the borrower’s pledged assets.

Step 9 – Signatures:

- Fill in the required date (dd/m/yy format).

- Borrower must print/sign their name.

- Lender is required to print/sign their name.

- AND

- Witnesses MUST sign the form.

Wyoming Secured Promissory Note – Adobe PDF – Microsoft Word