|

Rhode Island Unsecured Promissory Note Template |

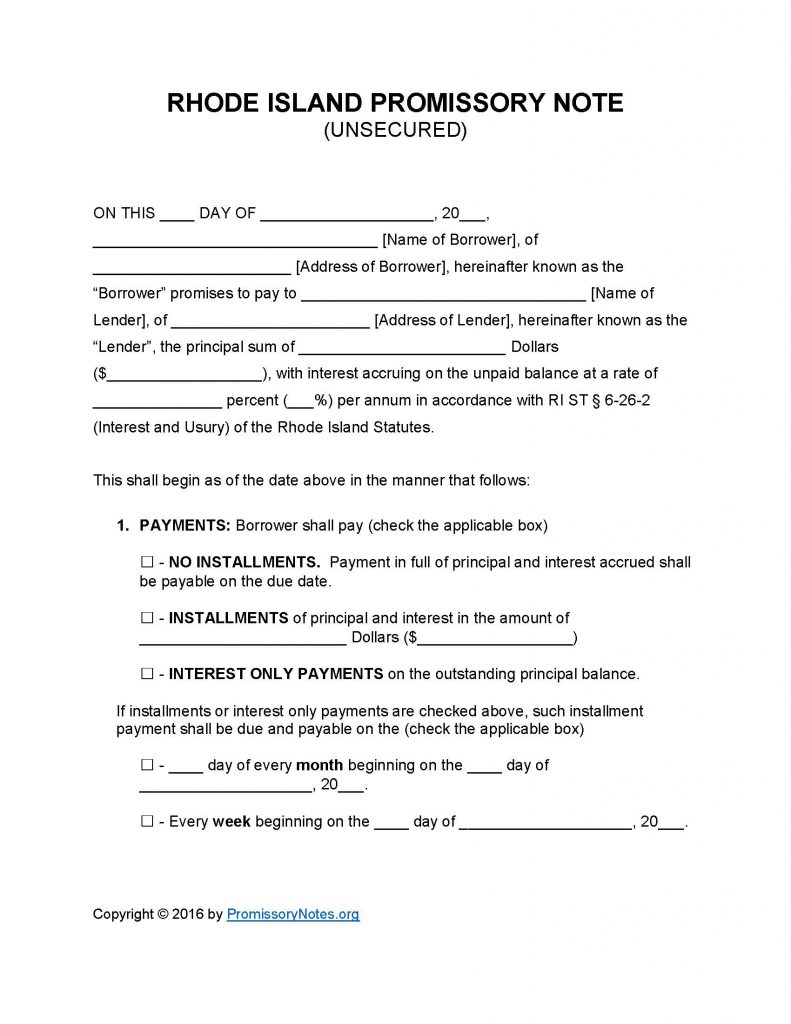

Use the instructions posted below to learn how to draft the Rhode Island Unsecured Promissory Note Template. The template was specifically created for Rhode Island residents. Promissory notes are essentially a type of written loan agreement between two parties (a lender and borrower). This template can only be used to draft an “unsecured” note (i.e. a note that isn’t backed by collateral).

Note: In order for the form to be legally enforceable it must contain the information described in the how-to guide posted below.

How to Write

Step 1 – Download the template.

Step 2 – Fill in the following details:

- Date of agreement

- Name/address of borrower

- Name/address of lender

- Amount that will be loaned to borrower

- Interest rate that borrower will be charged

Step 3 – Payments – Select the payment method the borrower has agreed to employ (from the following options):

- No Installments

- Installments

- Interest Only

Note: The installment amount must be submitted (if required) AND the monthly/weekly installment frequency must be provided.

Step 4 – Due Date:

- Submit the due date of the principal sum of the note.

Step 5 – Interest Due in Event of Default:

- Enter what interest rating the borrower must pay if they default on the loan.

Step 6 – Late Fees:

- Fill in the late fee that will be charged to the borrower if they miss a payment.

- AND

- Provide how long the borrower will have after missing a payment before the late fee is charged.

Step 7 – Acceleration:

- Submit the number of days the borrower will have to cure a default.

Step 8 – Signatures:

- Fill in the date.

- Enter the names of each party.

- ALL parties must sign the document.

Rhode Island Unsecured Promissory Note – Adobe PDF – Microsoft Word