|

California Secured Promissory Note Template |

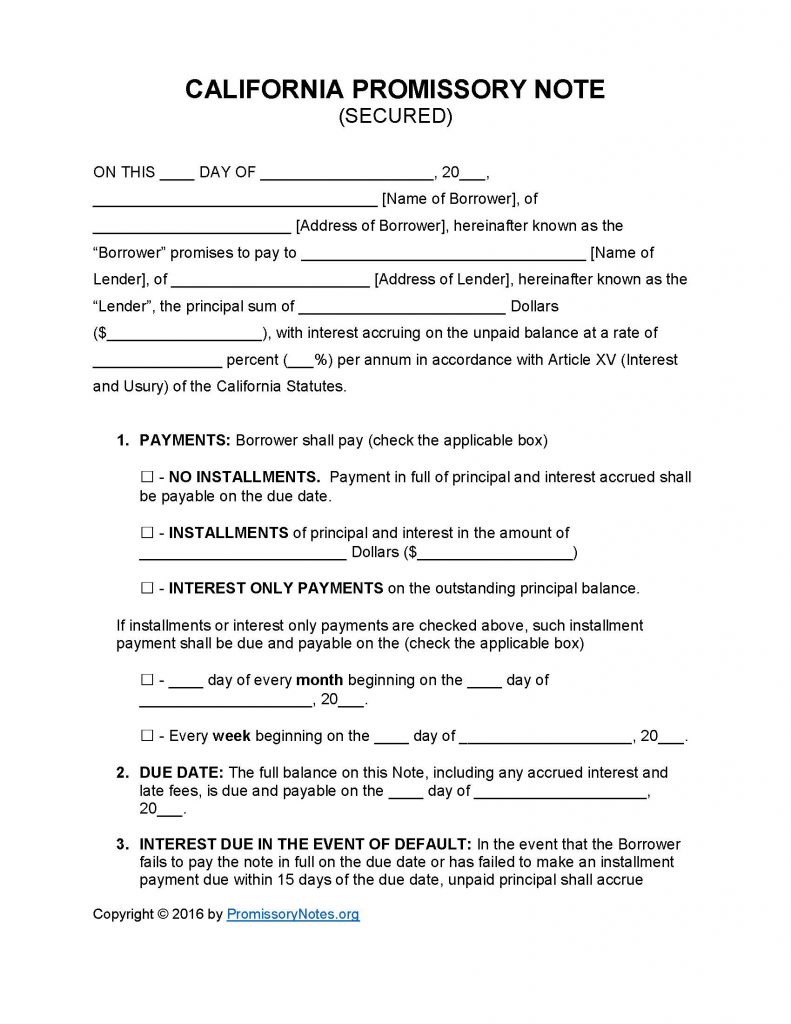

The California Secured Promissory Note Template can be downloaded in .PDF or Word format using the links provided on this page. Secured promissory notes are a type of contract entered into by a lender and a borrower. They are “secured” because they are backed by collateral (that is pledged by the borrower). If the borrower ends up defaulting on the loan (and does not “cure” the default in time), the lender can take possession of the pledged collateral. Most financial institutions will require that a loan be secured (if the borrower has anything less than excellent credit/a high net worth).

How to Write

Step 1 – Download the template.

Step 2 – On the first page, submit the following details into the input fields:

- Name of borrower

- AND

- address of borrower

- Name of lender

- AND

- Address of lender

- Principal sum (in USD)

- Interest rate (per annum)

Step 3 – Payments: Check the box of the payment method that the borrower will use.

- No Installments – Payment will be due in full on the specified date.

- Installments – Enter the payment amount (principal/interest). Check the appropriate payment schedule (weekly/monthly).

- Interest Only – Select the payment schedule and enter the weekly/monthly due date.

Step 4 – Due Date: The date that the full sum is due on. Enter the date in dd/m/yy format.

Step 5 – Interest in the Event of Default: The interest rate that will be applied to the balance should the borrower default on the note.

Step 6 – Late Fees: Fill in the late fee amount, as well as the amount of time the borrower will have to make a payment before any late fees are applied to the balance.

Step 7 – Acceleration: Should the borrower default on the note, they will have this number of days to “cure” the default. Failure of the borrower to cure the default allows the lender to make the full balance (in addition to any additional fees) due immediately.

Step 8 – Security: Submit a description of the pledged collateral.

Step 9 – Signatures:

- Fill in the date.

- All parties (lender/borrower/witnesses) must print/sign their names in the appropriate input fields on the last page of the note.

California Secured Promissory Note – Adobe PDF – Microsoft Word